The Ultimate Guide for Traders and Investors : Trend Following Strategies

One such approach that has found favor among traders and investors alike is trend following strategies, which allows traders and investors a systematic avenue to profit from market moves.

- So what makes these strategies work so well? Knowing where the trends lie, what the risks are, and having a disciplined approach.

- If you are an individual investor, a daily trader, or a finance professional, this guide has what you need to know about trading strategies for trend following.

What is Trend Following Strategies?

Trend following is a trading strategy that has various different ways of spotting, entering, and exiting upward or downward market trends.

- It is based on the concept that markets have a tendency to trend long term and that these trends can be profitable if you find them at the beginning.

- These strategies try to go long and/or short in the direction of the trend and remain in position until it reverses.

- It enables traders to stay in the trend for a longer time which increases the potential of maximizing profits while lowering risk.

Definition and Key Concepts :

Trend Following: Is a Trading Strategy that seeks to capture gains through the analysis of an asset’s Momentum in the Direction of an Asset Price, supported by fundamental news data.

- Unlike other strategies that may attempt to predict the market, trend followers are reactive, trading on the market only after a trend has been formed.

- The maxim says it all: “The trend is your friend until it’s not.”

Identifying Trends :

Trend following strategies first starts with identifying a trend in a market.

- Technical analysis is one way( study of charts, price patterns to look for trends) to do this.

- Trend followers also use indicators like moving averages, trend-lines, support and resistance levels, and various oscillators as confirmation of the trend.

- We should take into account that there is no exact science when it comes to identify a trend, which means that it can be more or less subjective.

- But by cross-referencing several indicators and looking at longer time scales, one can improve the signal-to-noise of their analysis.

Technical Indicators :

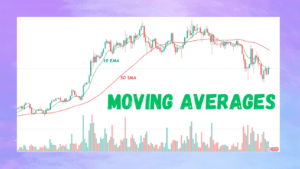

Moving Averages :

Simple Moving Average (SMA):

- Average price over a certain time period

Exponential Moving Average (EMA):

- Puts more importance on recent prices, more responsive to changes

Relative Strength Index (RSI) :

- The RSI is used to measure the relative magnitude of recent gains and losses, which is useful for identifying overbought or oversold conditions.

- Readings above 70 signal an overbought market, while readings below 30 signal an oversold one.

Trend-lines :

- Trend-lines are diagonal lines drawn on a chart to link consecutive highs or lows. They can help in determining the strength and direction of a trend. The break of a trend line signals possible trend reversal.

Support and Resistance Levels :

- Support is a price level that has proven to be strong, preventing a further fall.

- Resistance levels, on the contrary, are the price levels at which selling pressure has historically been able to restrain further upward price movement.

- Such levels serve as support or resistance and signal price reversal points in future.

Managing Risk :

- Risk management is essential for trend following, just like any trading strategy.

- As trends have a tendency to reverse back at any given time, you should definitely have a risk management policy in place to reduce the chances of a loss.

- This includes placing stop-loss orders, making sure that the maximum size of your trades do not exceed a certain percentage of your total capital, and spreading your capital across a number of different holdings.

- Furthermore, ongoing assessment and modification of your risk management techniques are critical for your long-term success.

Bollinger Band :

The bollinger band indicator has three reward line: middle line, upper and lower.

- The middle line is usually a 20-period simple moving average, with the upper and lower bands being deviations from it.

- Traders can use this information to make sense of price action by plotting price against these bands, which helps to isolate high volatility versus low volatility and potential reversals in trend.

Moving Average Convergence Divergence (MACD) :

It measures the relationship between two moving averages and shows shifts in momentum.

- A positive MACD will indicate upward momentum, while a negative MACD will indicate downward momentum.

- If the MACD crosses above or below its signal line, where the two lines also cross, that could indicate potential buying or selling opportunities in concert with the trend.

Discipline and Psychology :

As such, trend following strategies are discipline demanding a mindset of strength.

When the market is volatile, or you are experiencing some losses, you need to keep to your strategy.

Traders need to stay focused and avoid letting greed and fear divert them from their plan, this can prove profitable or too costly.

Hence, a clear-cut trading plan alongside emotion-management, and staying away from rash decision making is vital for becoming a successful time trader over the long run.

Price Action Trading : A Beginner’s Guide :

Traders who use only price charts to make decisions are called price action traders and this is a popular trading strategy.

- It focuses on basic technical analysis with market trends, support and resistance levels, and candlestick patterns to find potential trades.

- It is premised on the premise that everything there is to know about a market is reflected in its price action which is what makes it such a powerful tool for trend followers.

The Technical Analysis of Chart Patterns and Price Action :

- Things like flags, pennants, and ascending triangles tell us about possible trend continuations or reversals.

- It works well for price action strategies, which analyze the movement of prices without considering indicators.

- This includes sections of pure candlestick patterns, market support and resistance levels, and trend lines.

Risk Management in Trend Following Strategies :

- And no trading strategy is without risk, and trend following is no different.

- But risk management techniques can mitigate this risk. So some things to keep in mind when handling risk in trend following strategies:

Diversification :

- Investing in different markets and assets can help to reduce the potential fluctuations of returns on any single market or asset.

Position Sizing :

- Position sizing in relation to your risk appetite along with the risk-reward tradeoff you can expect in any given trade is key to continued risk management in trend following strategies.

Confirmation by using multiple indicators :

- Using multiple indicators together allows you to confirm the same trends and avoid false signals.

How Trend Following strategies Attracts Different Types Of Investors :

- You can use trend following strategies in multiple markets: stocks, commodities, forex, crypto.

- Its flexibility is what makes it go-to price action tool for traders, regardless of their time frame.

- Additionally, by basing it’s conclusion on observable market behavior (as opposed to speculation), the methodology is aimed at being as accessible and reliable as possible.

Trend Following and Risk Management :

Trend following is a trading strategy subject to risks, just like any other.

- But don’t panic; a good trend following strategies should reduce the risk to your portfolio significantly. Here are few risk management principles to consider:

Set Stop Losses :

- Make sure to use stop losses, which are predetermined points where you get out of a position when the price goes against you.

- They can also help prevent losses and lock in profits.

Diversify Your Portfolio :

- As trend following strategies generally operate across a range of positions within a variety of markets, this disperses the impact of a significant move in any given market on the total portfolio.

Apply Position Sizing Techniques :

- especially when implementing trend following strategies, position sizing is crucial for risk management and maximizing the potential for returns.

- The most widely used method is utilizing the

Stop-Loss Orders and Position Sizing :

- Stop-loss You will need stop-loss to exit from a trade at a predecided point in a trade if trend reverses. Therefore, position sizing helps you to only risk a small portion of your capital on every individual trade.

Managing Draw downs and Volatility :

- That may mean times of draw downs for trend following strategies. Tool working on portfolio balancing will help with this problem.

The Importance of a Disciplined Approach :

- Maintaining a consistent set of rules holds the key to long-term success, despite the waves of agony or ecstasy.

- A solid discipline makes up the core of any trend-follower strategy.

Proven Trend Following Strategies :

Moving Average Crossover Strategy :

- This means that, a short-term (moving) average crossing a long-term (moving) average upwards is a prospective uptrend (and vice versa for downtrends).

Breakout Strategy :

- A breakout is when prices rise above or fall below a support or resistance level.

- So the strategy means you buy when the price breaks above resistance and sell when it breaks below support.

Buy-and-Hold Strategy with Trailing Stops :

- This is a strategy that buys an asset when the price is going up and sells it based on trailing stops.

Breakout Strategies with Volume Confirmation :

- Michael Alexander, a trader with experience in analyzing markets, can directly identify key levels of support and resistance.

- A breakout above these levels, often accompanied by higher trading volume, is generally indicative of a new trend being established.

Using Trailing Stops to Maximize Profits :

- Trailing stops enable you to secure profit whenever the trend continues but to minimize losses if the market reverses.

The Psychology of Trend Following Strategies :

Overcoming Emotional Biases :

- They say fear and greed are the two biggest enemies of the trader. Having a set of rules to follow takes away the emotional side of making decisions.

The Importance of Patience and discipline :

- Trends don’t form in a day. Focus the looking of patience and make the right signals, that only would lead to success.

Adapting to Changing Market Conditions :

- The markets are continually shifting, and so must your strategies. Systemic to optimize, Reassess and adapt your systems periodically.

Essential Tools and Resources :

Tools and Platforms for Analyzing Trends :

Platforms such as Meta Trader and Thinkorswim have powerful tools for trend analysis.

- Real-time data with advanced chart features; These can be accessed via charting software such as TradingView.

Why Trend Following Strategies Belongs in Your Investment Strategy :

Trend following is not just a strategy, it’s a mindset.

- By basing your approach on market behavior that you can see and using strict, data-driven methods, you can stack the odds in your favor.

- With data, you are a beginner or a seasoned trader, incorporating trend following strategies into your portfolio can deliver more consistent results.

- Take small steps, be disciplined, and pivot as you progress.

- Explore our insights and connect with trend following strategies experts for more. Don’t follow – make it work for you.

Frequently Asked Questions :

What is trend following in trading?

Answer :

- A trading strategy that seeks to identify and profit from momentum in a given market is known as trend following.

- This method is used by traders who like to leverage upward or downward trends across a variety of markets.

How do I start using trend following strategies?

Answer :

- For example, learn about important technical indicators, including moving averages, RSI (relative strength index) and MACD (moving average convergence divergence).

- Start small by testing at scale in the real market after back-testing strategies on historical data.

Is trend following strategies suitable for beginners in trading?

Answer :

- Yes, trend following strategies is suitable for beginners since it is developed based on is observable market trends and not based on predicting future movements.

- But in order to achieve success over the long term, it takes discipline and patience and understanding of the principles of risk management.

What are the risks of trend following strategies?

Answer :

- These signals could send false signals, reversals in the trend, or swings in the market.

- Minimizing losses and protecting your capital is paramount, so risk management — including setting stop-loss orders and having a diversified portfolio is crucial.

Can trend-following strategies be automated?

Answer :

- Yes, trend following strategies can be automated using trading algorithms or bots.

- This approach is especially useful in coding specific entry and exit rules based on technical indicators, allowing traders to execute trades without emotional bias, and also increasing efficiency in capturing market trends.