Day Trading Strategies for Trend Traders :

Day trading strategies for success such as trend trading, breakout trading, and scalping. Understand the importance of risk management in day trading and how to protect your capital.

- Develop a solid plan and stick to it for success in day trading. Back test and refine your strategy before risking real money in the market. Happy trading!

- If you’re interested in the fast-paced world of day trading, you’ve come to the right place.

- In this article, we will explore some effective day trading strategies that can help you navigate the unpredictable nature of the stock market and increase your chances of success.

Trend Trading – Learn Day Trading Strategies :

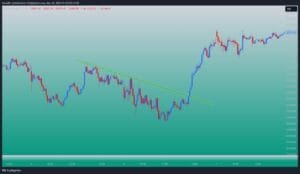

One popular day trading strategy is trend trading. This approach involves identifying and following the current trend in the market.

- Traders who use this strategy aim to profit from the momentum of a particular stock or market trend.

- To implement this strategy, traders analyze charts and technical indicators to identify the direction of the trend.

- They then enter trades in the same direction as the trend, hoping to ride the wave and make a profit.

- It’s important to note that trend trading requires patience and discipline, as it may involve holding positions for an extended period.

Breakout Trading – In Day Trading Strategies :

Another strategy commonly used by day traders is breakout trading. This approach involves identifying key levels of support and resistance and entering trades when the price breaks out of these levels.

- Traders using this strategy look for stocks or other financial instruments that are trading within a range. They wait for a breakout above the resistance

- Traders employing the best day trading strategies focus on identifying stocks or financial instruments that exhibit consolidation within a specified range.

- They patiently await a breakout either above the resistance level or below the support level before initiating a trade.

- By capitalizing on the subsequent momentum generated from the price movement breaking out of the range, traders aim to achieve profitable outcomes.

- level or below the support level before entering a trade. The idea is to catch the price movement as it breaks out of the range, hoping to profit from the subsequent momentum.

Scalping – Follow Day Trading Strategies :

Scalping is a Day trading strategy that involves making multiple trades throughout the day to capitalize on small price movements.

- Traders who use this strategy aim to take advantage of short-term fluctuations in the market.

- To implement this strategy, traders look for stocks or other financial instruments with high liquidity and tight bid-ask spreads.

- They enter and exit trades quickly, often within seconds or minutes, aiming to capture quick profits on each trade or day trade.

- Scalping requires a high level of technical analysis, focus and discipline, as traders need to closely monitor the market and make quick decisions.

Risk Management – In Day Trading Strategies :

Regardless of the strategy you choose, day traders effective risk management is crucial in day trading.

- The volatile nature of the market means that losses can occur, and it’s important to protect your capital. Don’t do Putting stop-loss orders in place is a typical risk management strategy.

- These orders automatically close a trade if the price reaches a predetermined level, limiting potential losses. Traders also use position sizing techniques to ensure that each trade represents a small percentage of their overall capital.

- Understanding Risk Management: Protecting Your Investments :

- Investing in the financial markets can be thrilling, but it also comes with its fair share of risks. That’s where risk management steps in – it’s like having a safety net to protect your hard-earned money from unexpected market movements.

Successful traders can follow Observe market sentiment, Technical analysis, risk management, and Control fear & Greed.

- So, what exactly is risk management? Think of it as a set of day trading strategies and practices designed to minimize potential losses while maximizing potential gains.

- In simpler terms, it’s about being smart with your investments to ensure you don’t lose more than you can afford.

- Risk management is understanding your risk tolerance.

- Everyone has a different comfort level when it comes to taking risks – some people are willing to take on more risk in exchange for the possibility of higher returns, while others prefer a more conservative approach.

- By knowing where you stand on the risk spectrum, you can tailor your investment strategy accordingly. Risk management also involves setting clear goals and sticking to a disciplined investment plan.

- By knowing Price action patterns, future price movement, Price volatility, price fluctuation understand the price charts and chart patterns. Trading in day trading or intraday trading using active trading strategies and trading volumes and technical analysis follow the day trading rules like experienced traders.

This means defining your investment objectives, whether it’s saving for retirement, buying a house, or funding your child’s education, and then creating a roadmap to achieve those goals.

- By sticking to your plan and avoiding emotional decision-making, you can reduce the likelihood of making impulsive investment choices that could lead to losses.

- Of course, even with the best risk management strategies in place, there’s always the possibility of unforeseen events impacting the markets.

Swing traders capitalization on price moves by holding short-term trades for days or weeks.

- Successful day traders who close day trading risks and positions within a market sessions, swing trading allows more flexibility and while still requiring strong trading decisions.

- Using a best trading platform, traders analyze the chart patterns, daily charts, and fundamental analysis to active traders potential entry points and exit points at price targets key price levels.

- Trading activity is influenced by market volatility, price swings and market psychology.

Using risk management techniques is absolutely essential to prevent financial risk and capital loss.

- When price objectives touch, trend trades like in bearish trends the market presents trading opportunities.

- The day trading position, Margin trading can amplify gains but increases day trading risks also. Following the rules of day trading, setting an entry price level, and knowing when to exit position help individual traders succeed.With effective strategies and stock market analysis, active traders can navigate stock trading confidently while managing risks.

- That’s why it’s essential to regularly review and adjust your investment portfolio as needed.

- By staying informed about market trends and economic developments, you can make proactive adjustments to your portfolio to mitigate potential risks.

Risk management is a vital aspect of successful investing.

- By diversifying your investments in equity market, stock traders, understanding your risk tolerance, setting clear goals, exit criteria and staying disciplined, you can protect your investments and increase your chances of achieving long-term investment goals and potential profits.

- Remember, investing is a journey, and with the right risk management strategies in place, you can navigate the ups and downs of the market with confidence

Develop your trading plan.

Creating a solid trading plan is a critical element for any day trader aiming to succeed in the often volatile and unpredictable world of financial markets.

- A well-thought-out trading plan not only outlines your approach to trading but also serves as a guide to help you make informed decisions, keeping emotions at bay during trading sessions.

Define Your Goals

The foundation of a successful trading plan begins with defining your goals.

- Ask yourself what you want to achieve through day trading.

- Are you looking to generate additional income, save for a specific purchase, or build a long-term wealth portfolio? Clearly outlining your short-term and long-term goals will help you remain focused and committed to your trading strategy.

Choose Your Trading Style

Your personality and time commitment significantly influence your trading style. Common styles include:

- Scalping: This scalping strategy on trading day involves making number of small and retail traders trades throughout the day to capitalize on minor price movements. Scalpers are usually hold the positions for seconds to minutes only.

- Momentum Trading: Momentum traders look for stocks or assets that are trending significantly in one direction and aim to capitalize on this trend. This often requires quick decision-making and responsiveness.

Maintain Discipline

Discipline is one of the most critical components of successful day trading.

- In a market that can swing wildly in a matter of minutes, maintaining a disciplined approach can help you avoid impulsive decisions that often lead to losses. Here are some key practices to cultivate discipline in your trading strategy:

Stick to Your Trading Plan

Your trading plan is your roadmap, and just like any journey, it is essential to stick to it.

- When you deviate from your plan due to emotions or market noise, you risk incurring unnecessary losses.

- Rigorously adhering to your established rules regarding entry and exit points, risk management, and profit targets helps ensure consistency in your trading performance.

Avoid Emotional Trading

Trading based on emotions such as fear or greed can lead to poor decision-making.

- It’s crucial to remain calm and rational, especially in times of volatility. Consider employing techniques such as mindfulness or journaling to keep track of your thoughts and emotions during trading.

- Reflecting on past trades can provide important insights into emotional triggers and help develop a more disciplined mindset.

Set Realistic Expectations

Day trading is not a guaranteed way to make money, and expecting consistent profits can lead to frustration and hasty decisions.

Conclusion :

Day trading Strategies can be an exciting and potentially lucrative endeavor, but it’s important to approach it with a well-defined strategy.

- Whether you choose trend trading, breakout trading, scalping, or a combination of strategies, remember to practice risk management and stay disciplined.

- The key to success in day trading lies in developing a solid plan and sticking to it.

- We hope you found this article helpful in understanding some popular day trading strategies. Remember, practice makes perfect, so take the time to back test and refine your strategy before risking real money in the market. Happy trading!