Unlocking the Mystique of Three Black Crows Pattern in Market Analysis :

As financial markets perform their wild dance, patterns provide informed observers a glimpse of an uncertain and probabilistic future. One such pattern, known for its bearish characteristics and past movements, that captures traders and analysts alike is Three Black Crows.

- Investors find this indicator an intriguing combination of past movements and possible future market sentiment.

- This blog post does not offer investment advice nor an insight into financial markets, rather it will introduce the Three Black Crows pattern and how it can be identified, its significance in market analysis; and strategies for application.

- Regardless of whether you’re an experienced stock market investor or just beginning trading, understanding this pattern can be an invaluable addition to your toolbox.

The Three Black Crows Pattern :

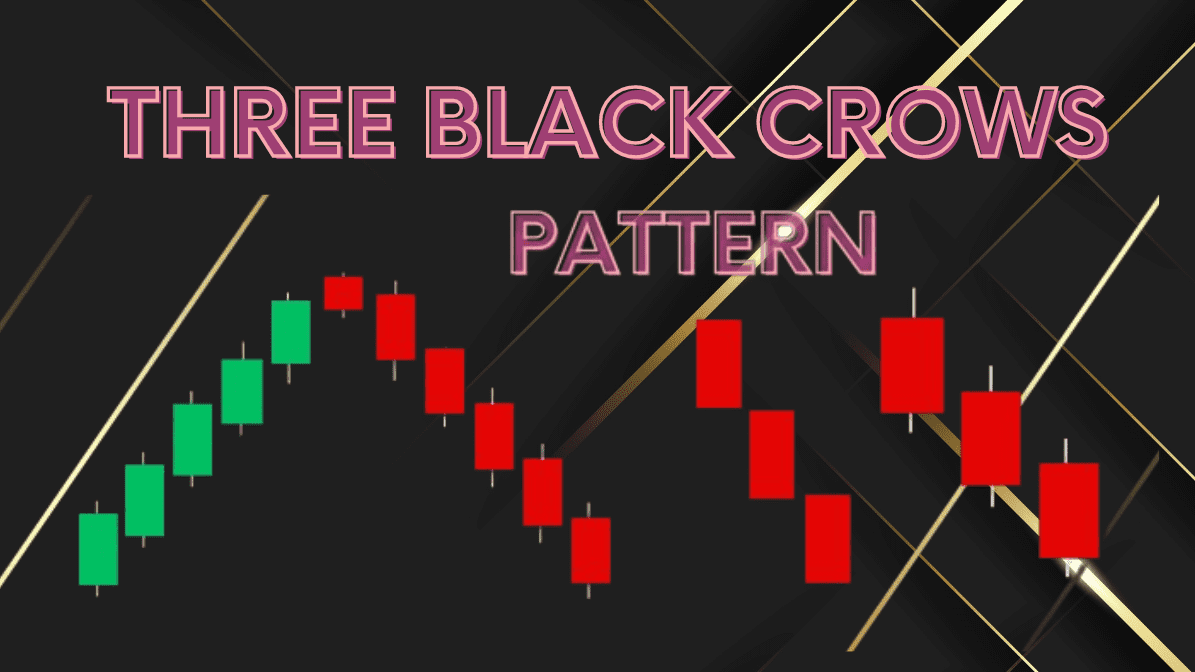

- The Three Black Crows pattern is a bearish candlestick formation. It consists of three consecutive long-bodied candlesticks that both open and close within their respective bodies on successive trading days, typically their opening prices tend to fall nearer the high and closing prices nearer the low of each session.

- This signal often signals that a security is in a strong downtrend that may continue over time.

- An unexpected series of bearish candlesticks can be alarming for market bulls. Each visual representation carries with it an emotional weight telling a tale of three consecutive days where sellers have controlled price action.

Identification of Three Black Crows Pattern :

- A key to spotting the Three Black Crows on a chart lies in its visual structure and sequence of candlesticks. A hallmark of success will be three long-bodied candlesticks opening within the real body of their predecessor and closing near period lows.

- In an ideal scenario, these three candles should progress downward with each opening occurring near the high of the day and closing near its low.

- Additionally, there should be minimal to no shadow on either of their upper sides, indicating minimal buying pressure intraday.

The Prophetic Implications of Three Black Crows Pattern :

- The Three Black Crows pattern has historically been linked with an increased chance of bearish reversals for any stock or financial instrument under scrutiny.

- When this pattern appears after an extended uptrend, traders and technical analysts often interpret its appearance as signalling significant change in market sentiment and suggesting selling pressure has significantly increased, tipping the balance of power in favor of sellers over buyers.

Charting Performance :

- Studies aimed at quantifying its effect often measure how often an indicator leads to bearish reversal, with studies using Three Black Crows patterns as one such indicator.

- Over the years, this pattern has proven impressively reliable; however it should be remembered that no indicator or tool can guarantee 100% reliability, many times markets continue their upward movements even after formation of this pattern, this emphasizes why traders must utilize it alongside other analysis tools and strategies.

Real-World Examples of Three Black Crows Pattern in Charts :

- Examine charts of major stocks or financial indices to detect instances of the Three Black Crows pattern before significant downtrends, like 2008 financial crisis when S&P 500 displayed this phenomenon before it collapsed this pattern could also be found across other stocks and assets as a wider indicator.

- At COVID-19 Financial Crisis of 2020, Three Black Crows pattern made an unnerving reappearance. Prior to the unprecedented global shutdown, markets were at all-time high.

- When news of pandemic spread, uncertainty set in and Three Black Crows pattern appeared across multiple market sectors heralding sharp downturn. Investors who recognized it early could adjust strategies appropriately in anticipation of bearish trend that followed.

Trading Under The Shadow of Black Crows Pattern :

- Recognizing the Three Black Crows pattern is only half the battle; effectively integrating it into your trading strategy will reveal its true worth. There are various approaches available that will allow you to harness its full potential without succumbing to its bearish gaze.

Integration of Three Black Crows Pattern Into Your Trading Strategy :

- Timing Bearish Entries: After an uptrend has ended and when this pattern appears after it, now may be an ideal time to consider taking short positions, however waiting for confirmation from other technical indicators may help ensure you enter trades with more confidence.

- Risk Management: Consider carefully when placing stop-loss orders due to the potential reversals predicted by patterns, losses can be substantial if markets deviate from expectations.

- Combining With Other Indicators: When it comes to using The Three Black Crows, don’t use it alone pair it with volume analysis, moving averages or other technical tools in order to confirm your analysis.

Steering clear of misconceptions :

- Though the Three Black Crows pattern is often taken as an indicator of bearish sentiment, no single pattern or signal guarantees market outcomes.

- Before making any trading decisions based on such patterns or signals, always carefully consider all available information before making decisions based on them.

Context and Market Conditions Are Vital :

- Every Three Black Crows Pattern Is Unique Context and market conditions matter greatly when interpreting this pattern.

- Three Black Crows formation seen after a minor rally in an otherwise bearish market may not carry as much significance than one observed after an extended upward movement.

Always Trade Responsibly :

- Finally, always trade responsibly. Do not over-leverage positions or trade solely based on this pattern instead combine it with extensive fundamental analysis and sound risk management practices for optimal success.

Expert Perspectives on Three Black Crows Pattern :

- For expert insight on the Three Black Crows pattern, we consulted leading market analysts.

- Some agree it can be an important signal but should always be combined with other indicators, other analysts suggested watching out for oversold conditions after seeing this pattern as this could potentially signal mean-reversion rallies in prices.

Conclusion :

- The Three Black Crows pattern, known for its unnerving name and visual, has earned itself a formidable reputation among investors and traders.

- Historically, it has signaled major downtrends that allow investors and traders to alter their positions accordingly and take advantage of bearish market moves.

- But successful trading requires both art and science Three Black Crows should simply be considered one aspect in an extensive analysis process.

My advice would be to take every signal seriously but never accept any one signal on its own.

- Employ the Three Black Crows as a tool to initiate further investigation of potential bearish sentiment in the market, remembering that markets can remain unpredictable longer than you can be solvent and thus using these and all tools carefully and judiciously.

- No matter your level of involvement with financial markets, or simply an observer, the Three Black Crows pattern provides invaluable insights into market movements.

- I urge you to share your experiences in identifying and using bearish indicators such as Three Black Crows pattern collective learning is what powers better trading decisions, so stay informed, stay curious, and most of all trade safe.

Frequently Asked Questions :

What Is the Three Black Crows Pattern?

Answer :

- The Three Black Crows pattern is a bearish reversal indicator composed of three long-bodied candlesticks which opened within their previous candle’s body but closed lower, suggesting a change from bullish sentiment to bearish market sentiment.

How reliable is the Three Black Crows pattern?

Answer :

- While the Three Black Crows pattern can serve as an effective signal of bearish reversals, its accuracy must still be verified with other technical analysis tools and market conditions for maximum reliability.

Can the Three Black Crows Pattern Appear at Any Time frame?

Answer :

- Yes, the Three Black Crows pattern can appear at any time frame from intraday charts such as 1-minute or 5-minute charts to longer time frames like daily, weekly or monthly charts. Although longer time frame patterns tend to carry greater weight.

Should I take action immediately upon spotting a Three Black Crows pattern?

Answer :

- Rather, wait for additional confirmation through other technical indicators or fundamental analysis in order to validate potential bearish reversals as this reduces false signals and lowers risk.

What should I do if the market does not follow the Three Black Crows pattern and indicate a bearish reversal?

Answer :

- Ideally, if the market does not follow through with its predicted bearish reversal as indicated by the Three Black Crows pattern, it is vitally important to have a risk management strategy such as stop-loss orders in place to limit potential losses.

- Markets can be unpredictable, no single pattern can guarantee market movements.