The Spinning Bottom Pattern : A Guide for Forex and Stock Market Traders

Candlestick patterns serve traders like musical note, they create an orchestra of market movement. Candlestick compositions with spinning bottoms serve as an invaluable way for traders to predict market reversals.

This comprehensive guide deconstructs and analyzes the spinning bottom pattern from its inception, its significance in markets like Forex and stocks, and offers actionable strategies for including this pattern into your trading repertoire.

Whether you are an experienced market trader honing their trade or newcomer to financial services, understanding and mastering this phenomenon could be the key to unlocking success for you!

Understanding the Spinning Bottom Pattern :

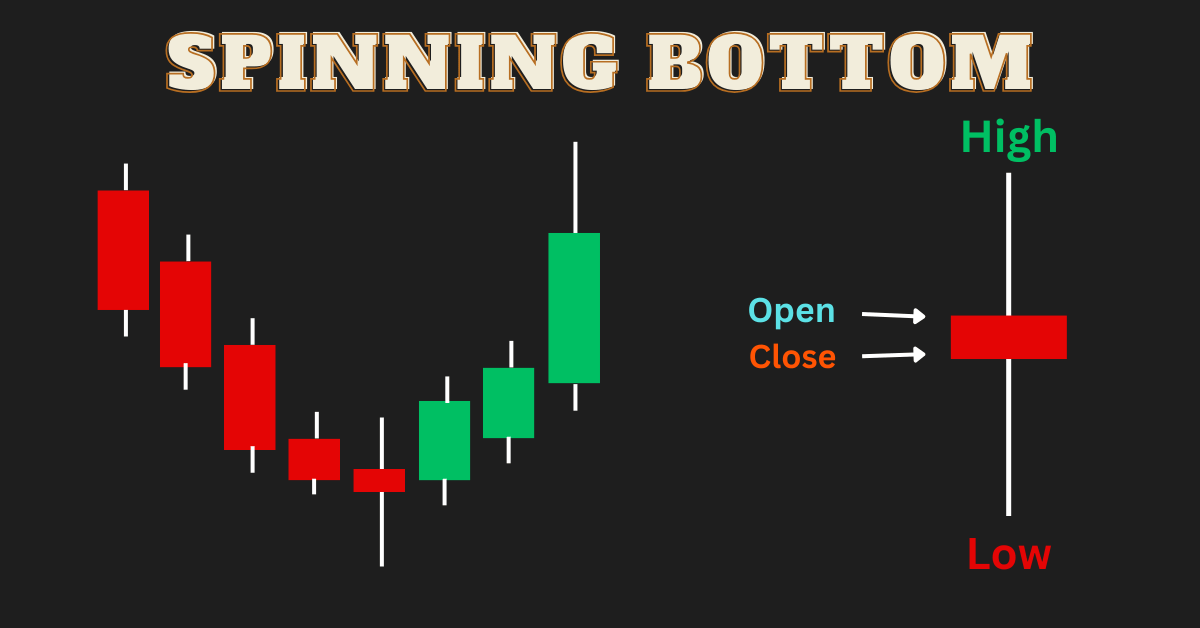

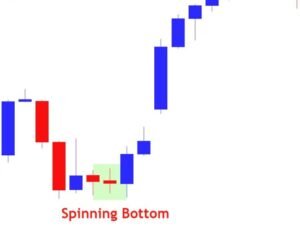

A spinning bottom candlestick pattern usually features a small real body (the difference between open and close prices) with long upper and lower shadows that resembles that of a spinning top, hence its name.

Market psychology behind the pattern can also be quite telling its small real body indicates neither bulls nor bears could maintain control during session while its long upper and lower shadows indicate significant buying and selling pressure occurred, creating a tug-of-war and possibly signalling fatigue in current trends as well as potential change of direction.

Market Relevance and Implications :

Spinning bottoms are highly relevant to traders looking for changes to trend changes on their charts.

An uptrend could signal bulls losing steam while, during a downtrend, it might indicate bears tiring out. Its implications will differ based on factors like asset being traded, time frame and the overall context of the market.

Formation of the Spinning Bottom Pattern :

To identify a spinning bottom pattern in nature, one must understand its anatomy.

Three main characteristics of a spinning bottom include its small real body that forms at an equal point between high and low prices, its shadows which should at least two times larger than its real body and an indecision period that usually follows after strong upward or downward moves have taken place.

When price action forms a spinning bottom this represents indecision after strong moves either upwards or downwards have taken place.

Timing the Reversal :

Timing a Reversal It’s essential that reversals take place at just the right moment. A spinning bottom pattern can be most significant when appearing near key support or resistance zones or when overbought or oversold conditions arise, providing context.

A spinning bottom’s relevance cannot be judged simply from appearing randomly, when formed under suitable conditions it can serve as an early warning that trends are about to turn.

Applying Spinning Bottom Pattern Strategies :

Knowing when and where to apply spinning bottom pattern strategies is an art in trading. Here, we will outline various techniques for using this pattern to improve decision making processes.

Combining Spinning Bottom with Other Indicators :

One approach is to combine spinning bottom patterns with other technical indicators such as moving averages or volume analysis, to reinforce their signals and strengthen trading decisions.

For instance, a spinning bottom located near a 200-period moving average may signal strong support levels that could signal potential trend reversals and possibly signal strong support levels that signal possible support levels or trend reversals.

Trading Setups for Different Time frames :

The impact of a spinning bottom may vary significantly depending on its significance and interpretation, with intraday traders seeking them out more frequently on shorter time frames than swing or position traders who place more weight on patterns observed over longer time frames such as daily or weekly charts.

Make adjustments in your trading setups accordingly to take these differences in interpretation and execution into account.

Risk Management with the Spinning Bottom Pattern :

No trading strategy can be complete without an effective risk management plan, and this strategy is no exception.

To succeed with the spinning bottom pattern strategy, traders need to establish clear entry and exit points, utilize stop-loss orders, and avoid over leveraging their positions.

By structuring your trades around this approach and managing risk properly, you can achieve higher returns while protecting capital.

Case Studies and Real-World Application :

To illustrate the practical application of the spinning bottom pattern, we will present case studies and real-world applications which illustrate its significance in various market environments from in-depth analyses of specific Forex pairs to stock market volatility during corporate earnings periods these examples will show traders how they can use this strategy effectively.

Examining a EUR/USD Daily Chart Case Study :

Carefully study a EUR/USD daily chart and identify an area that may serve as support, including any spinning bottom formation at key support levels. Keep an eye on price action following this pattern to gain an insight into whether trend reversals may occur.

Apple (AAPL) Stock Weekly Chart Case Study :

Take a close look at Apple (AAPL) stock’s weekly chart and notice when significant selling pressure occurs, then observe as the trajectory changes after formation of a spinning bottom signaling reversal.

Gold Futures (GC) Intraday Example :

mes Examine an intraday chart of Gold Futures to identify an unsteady bottom amid volatile trading, then monitor how this pattern impacts short-term market movements.

Advanced Techniques and Next Steps :

To deepen their understanding of spinning bottom trading, advanced techniques like back testing and pattern recognition software may provide helpful support.

Furthermore, becoming familiar with variations such as inverted hammer or doji may offer further insights into market conditions.

As your skills progress further, consider integrating spinning bottoms into larger trading strategies to improve overall success rate keep studying and practicing to become a proficient spinning bottom trader Happy charting.

Conclusion :

The spinning bottom pattern is an effective trading indicator that can signal either trend reversal or continuation.

By mastering its recognition and interpretation, traders can gain an edge in the market and make more informed trading decisions although remember that trading is both art and science, its manifestation by spinning bottom patterns are simply one aspect of it all. Keep learning, adapting and trading wisely.

Frequently Asked Questions (FAQs).

What Is a Spinning Bottom in Trading?

Answer :

A spinning bottom candlestick pattern characterized by short body between long upper and lower shadows represents indecision among traders, suggesting a potential shift in current trend direction.

How Can I Recognize a Spinning Bottom Pattern on a Chart?

Answer :

To recognize a spinning bottom pattern on a chart, look for candlesticks with small real bodies placed centered in their candle and long shadows extending out from both ends – at least twice longer than their real bodies.

Why Is Timing of a Spinning Bottom pattern Important?

Answer :

A spinning bottom pattern’s significance increases when it appears near key support or resistance levels or during overbought/oversold market conditions.

Traders use its appearance to help gauge whether an imminent trend reversal might be imminent. Its appearance provides traders with invaluable signals of when they should expect potential reversals to take place.

Can the Spinning Bottom Pattern Be Combined with Other Technical Indicators?

Answer :

Yes, adding other indicators like moving averages or volume analysis can increase its reliability as an indicator and provide a clearer signal of its implications, facilitating more informed trading decisions and ultimately supporting greater stability for traders.

How Should I Manage Risk When Trading the Spinning Bottom Pattern?

Answer :

Always set clear entry and exit points, using stop-loss orders to limit potential losses. Furthermore, beware over leveraging and ensure each trade fits into your overall risk management strategy.