The Morning Star Pattern: A Guide for Savvy Traders

Candlestick traders and analysts who speak their language will recognize the Morning Star pattern as an invaluable way to predict significant market shifts. It signals potential trend reversals from bearish to bullish trends and offers invaluable trading clues if one knows where to look.

With this guide we aim to unravel its mysteries while exploring all it has to offer in financial trading.

Unveiling the Morning Star Pattern :

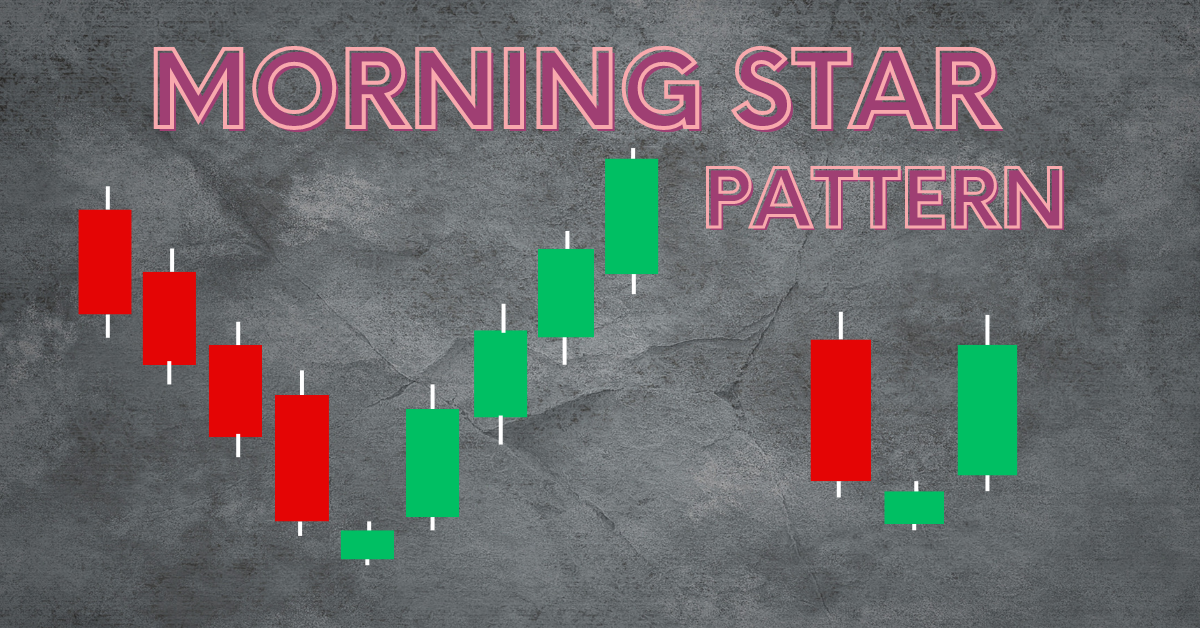

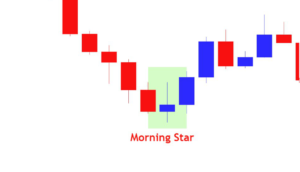

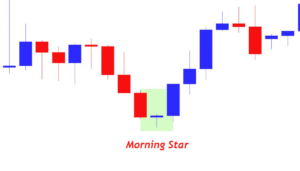

Imagine an empty night sky just before dawn. Financially speaking, this image translates into the Morning Star pattern a formation comprising three candlesticks that symbolizes new beginnings promising possible bullish reversal signals in its down trending manifestation.

The anatomy of this pattern is distinctive. It features three candlesticks as opposed to four for maximum impact.

- The first candle is long and bearish, signifying current downward price action.

- The second candle has a smaller body size and displays uncertainty that suggests potential slowing of bearish momentum.

- The third candle is long and bullish, signaling strong upward movement that could signal a potential new uptrend.

These elements, when taken together, form the Morning Star pattern that can have lasting implications for traders and investors alike.

Understanding It for Different Markets :

The Morning Star pattern’s potential for reversal holds true across numerous markets, from stock exchanges to forex.

Stock trading charts a Morning Star as an indicator of downtrend exhaustion and optimism emerging, for forex investors this signal could indicate weakening bearish trends or strengthening bullish ones, providing entry points.

Commodities traders also take note as this signal could signal early changes in sentiment following long downtrends.

Identification of the Morning Star Pattern :

To recognize the Morning Star Pattern, one must be familiar with its distinct characteristics.

As mentioned, its first candle should have a bearish and long body; subsequent candles should have smaller bodies, finally, its third should close above midpoint of first candle’s body for maximum impact.

Additional indicators like volume and price action can help confirm this pattern further.

Trading Strategies Employing the Morning Star Pattern :

Traders have devised various strategies for exploiting the Morning Star Pattern, depending on their risk profile and trading style.

Some traders may enter a trade as soon as the third candle closes while others wait for additional confirmation from other technical indicators before entering their trades.

They may also use it to set stop-loss/take-profit levels, as well as combine it with other chart patterns for an enhanced analysis.

Additional Strategies for Trading the Morning Star Pattern :

Although the classic interpretation of the Morning Star Pattern involves a bullish reversal, there are multiple variations and strategies traders can employ in order to increase profits while mitigating risk.

Here are a few other considerations when trading this formation.

- Bullish Confirmation : After the third candle has closed, traders should seek further bullish confirmation by monitoring price action in subsequent days or using indicators like moving averages to track price behavior.

- Multi Time Frame Analysis : Traders may also utilize various time frames to confirm the Morning Star Pattern, such as using daily charts as confirmation for weekly or monthly charts as needed.

- Leveraging Support and Resistance Levels : The Morning Star Pattern can become even more effective when appearing near key support levels, signaling potential reversals in the market. Likewise, pairing this pattern with resistance levels may offer invaluable insights for traders.

For those trading volatile commodities or indices, the Morning Star pattern can serve as a beacon of hope in turbulent waters.

It often appears in tandem with fundamental news or events which cause sentiment shifts; therefore, understanding and making use of this pattern are vitally important for anyone navigating the complex realm of trading.

Identifying Morning Star Patterns in Day Trading :

Day traders know the value of timing is essential, and the Morning Star pattern provides a precise temporal cue. Conceived over just three days its final stage being an entry signal into the market this indicator makes a useful companion tool for quick yet calculated trading moves.

To accurately recognize a Morning Star in day trading, look for

- Volume increase on the third candle

- Closure at least halfway up first candle’s body

- Cleanliness in formation without large shadows or wicks on candle

- To confirm a Morning Star correctly in day trading.

Day traders can capitalize on the momentum created by a confirmed Morning Star by using it as a springboard to take swift and potentially high-yielding positions.

Here Are Real-World Examples of Successful Morning Star Trades :

Market history abounds with examples where Morning Star patterns were heralds of profit.

- One such case is Apple Inc’s stock which displayed a Morning Star pattern in September 2018, signifying its end from an extended downward trend and heralding an extended period of gains.

- * After the EU referendum in 2016, EUR/USD forex pair showed a Morning Star pattern reversal signalling an end of its downward movement, signaling a turnaround.

- In February 2019 Bitcoin made another appearance of this Morning Star pattern that presaged an impressive bull run.

Real-life examples demonstrate the pattern’s usefulness across varying market conditions and its ability to guide traders toward positive outcomes.

Tips for Accurate Recognition and Confirmation :

Recognition and validation of Morning Star patterns is paramount for making informed trading decisions. To improve accuracy, traders should,

- Review volume trends to gauge the strength of third bullish candle and confirm its strength

- To further strengthen confirmation, utilize other technical indicators like moving averages or relative strength index (RSI).

- Wait for a fourth candle to form as additional confirmation that indicates an ongoing trend reversal.

Be wary of false Morning Stars as these could lead to major losses; always exercise due diligence and allow the pattern to fully develop before taking any steps.

Integrating Morning Star Patterns Into Your Trading Strategy :

Successfully incorporating Morning Star patterns into a trading strategy requires taking an in-depth approach. Start by understanding your risk tolerance and ensure the Morning Star fits within your overall trading plan. Consider these points when adding it into your strategy.

- Combine Morning Star with other technical analysis tools for a more robust approach

- Employ appropriate risk management techniques, such as setting stop-loss orders

- Integrate Morning Star into an overall analysis framework which considers both technical and fundamental aspects of the market.

Modify your strategies depending on the market you are trading in and time frame you are operating within, then regularly back test and refine them to get maximum benefit from this powerful pattern.

The Value and Future of the Morning Star Pattern :

For traders navigating the complicated realm of trading, the Morning Star pattern provides simplicity and promise.

Not only can it open up potential profits but its strategic insight gives traders greater advantage when engaging with market movements or recognizing shifts with greater precision.

By mastering this pattern, traders can more efficiently engage with market movements by tracking fluctuations more effectively while more quickly detecting shifts that are happening within it.

Future predictions point towards greater volatility, uncertainty and opportunity than ever before.

With technologically driven markets and algorithmic trading gaining prominence, human recognition of patterns remains invaluable so when it comes to trade patterns such as Morning Star pattern it remains relevant as an indicator of its permanence within markets an illustration of its ability to sustain us over time as market forces interplay together to shape trade cycles.

Note that The Morning Star isn’t a magic crystal ball, however, with practice and experience it can empower traders to make more informed decisions and capture potentially profitable moves.

Patience and precision will serve you well when searching for those exclusive “Morning Star” gains.

Conclusion :

Mastering the Morning Star Candlestick Pattern is an indispensable skill for traders in various markets.

By studying its anatomy, significance, and identification techniques, experienced traders can use this pattern to their advantage and potentially find financial gains in today’s ever-evolving markets.

Research and risk management are crucial elements of trading success with practice and patience, traders can incorporate the Morning Star Pattern into their arsenal for successfully navigating financial waters so keep an eye out for it in your trading charts it may guide informed decisions, Good trading.

Frequently Asked Questions :

What is the Morning Star Pattern and Why Is it Significant?

Answer :

The Morning Star pattern is a bullish reversal configuration recognized in candlestick charting that indicates an imminent transition from bearish to bullish market conditions.

It gives traders and investors early warning of trend reversals and allows an opportunity for entry before full rebound is realized.

How can I verify the authenticity of a Morning Star pattern?

Answer :

To verify a Morning Star pattern requires several steps. These include watching for an increase in volume on the third day (the bullish candle), as well as verifying that its body closed at least halfway up its predecessor candle’s body.

Traders frequently wait for another candle reversal pattern to develop as further evidence, or they use additional technical indicators as additional support.

Is the Morning Star Pattern Applicable Across Markets?

Answer :

Yes, the Morning Star pattern can be applied across various markets including stocks, forex, commodities, and indices. While its basic principles of signaling a potential bullish reversal remain universal, market specific factors may affect its occurrence and reliability.

What are some common mistakes to be wary of when trading the Morning Star pattern?

Answer :

Common errors include acting on Morning Star patterns without waiting for full confirmation, not using additional technical analysis tools as corroboration and failing to implement adequate risk management measures mistakes which can lead to false positives and excessive losses.

How does the Morning Star hold up in an increasingly algorithmic trading world?

Answer :

Even as algorithmic trading becomes increasingly prevalent, pattern-based strategies like Morning Star remain valuable. Human traders’ ability to interpret and respond quickly to market conditions adds another level of strategic insight that supplements algorithmic methods.

Furthermore, as markets develop further combining traditional patterns with modern technologies can enhance decision-making capabilities for more dynamic trading approaches.