The Art of Trading with Marubozu Candlestick Patterns :

As part of today’s fast-paced trading world, mastering chart reading can give you the edge you need to make informed decisions.

One powerful trading tool available to us all today is Marubozu Candlestick Patterns, an ancient Japanese charting technique with timeless appeal which remains relevant today and provides us with powerful trading insights.

Whether you are stock market investor, forex trader or technical analysis enthusiast learning its secrets could lead you towards profitable trades as well as providing deeper market understanding.

This guide will walk you through all you need to know about the Marubozu candlestick pattern, from its origins and strategies that can help leverage this strategy, all the way to becoming a more skilled and successful trader.

Before we dive deeper into Marubozu candlestick patterns, it’s essential to understand their role in trading.

Candlesticks are visual representations of price movements over a given period, comprising of an open/close price pair with shadows representing highest and lowest prices within it.

Different patterns convey specific signals which allow traders to predict future price movements more accurately.

The Marubozu Candlestick Pattern :

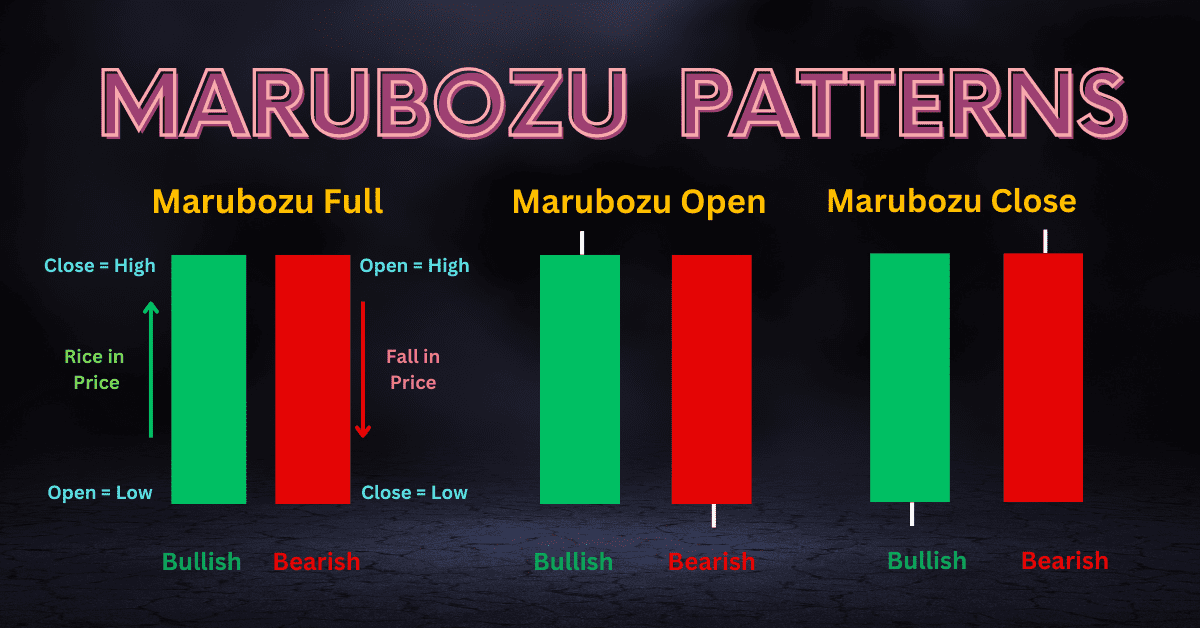

The Marubozu candlestick pattern is one of the simplest yet most powerful candlestick formations, formed by an extended body with few or no wicks (shadows), signaling strong trends either bullish or bearish depending on its color, for instance a bullish Marubozu occurs when its opening price coincides with its closing price whereas vice versa, otherwise known as black Marubozu.

Marubozu candlestick patterns stand apart from others by being strong predictors without needing further confirmation, due to their absence of shadows which indicate consistent buying and selling pressure throughout their respective time frames.

Marubozu’s Legacy :

Marubozu derives its name from an iconic warrior priest from Japanese history, making this pattern associated with strength and decisiveness in market trends.

Technical analysts often utilize Marubozu to gain clarity for trading decisions; rice traders in Japan initially used this pattern before later adopting it globally as an indicator of an impending major trend.

Interpreting Marubozu Formation in Different Market Contexts :

Understanding the market context in which Marubozu appears is vital to accurately interpreting its significance.

When occurring within an established trend, Marubozu signals a continuation of that trend’s strength with either bullish or bearish indications depending on where it forms.

When occurring within a trading range however, Marubozu may signal an upward or downward breakout respectively from within it, while occurring either near its top or bottom can signal potential reversals if combined with high trading volume.

Marubozus can serve as key indicators on longer timeframes, making them attractive tools for both swing and position traders.

Applying Marubozu Patterns Strategically :

When applied correctly, Marubozu patterns can serve as an invaluable indicator of entry and exit points in strategic trading.

Traders should wait for pullbacks after large trend movements to enter in the direction of an original

Marubozu formation, when exiting, use of unconventional orders can allow quick, decisive plays, day traders can combine Marubozus with other technical indicators for an even more reliable trade entry and exit system.

Real-World Success Stories with Marubozu :

While no strategy can guarantee 100% success, the Marubozu pattern has proven instrumental in numerous real-world trading success stories.

Traders who took advantage of Marubozu patterns at key price levels saw significant profits, one notable case being when bullish Marubozu formed after a major company introduced an innovative product leading to sustained uptrend.

On the flipside, bearish Marubozu predicted market downturn after economic indicators issued alarming news.

Fine-Tuning Your Marubozu Trading Skills :

To make the most out of Marubozu trading patterns, it’s crucial that your skills at recognizing and creating strategies tailored specifically to your risk tolerance and trading style are fine-tuned.

Regular back testing and analysis can assist with this goal while software and apps designed specifically to identify Marubozu patterns across markets and time frames are invaluable resources in finding Marubozu patterns in multiple markets simultaneously.

Identifying and Validating Marubozu Patterns :

In order to properly recognize a Marubozu candle’s body must extend at least three times further than the average daily range, and observe surrounding candle formations to confirm a strong directional bias.

Volume analysis can also be invaluable; Marubozu with higher volume tend to represent more reliable signals.

Integrating Marubozu into Larger Trading Strategies :

While Marubozu patterns can be powerful indicators, adding other technical analysis tools like trend lines, moving averages and oscillators can further strengthen their impact.

They can offer confirmation or additional views on price action that complement what Marubozu offers providing traders with insights they use when crafting complete trading systems that combine various indicators with those provided by Marubozu patterns.

Shaping Your Trading Adventure with Marubozu :

The Marubozu candlestick pattern is not simply an antique; it remains relevant and useful in today’s volatile trading world.

By understanding its significance and practicing using it in various contexts, the Marubozu can dramatically improve your trading skills no matter if you are new to trading or an experienced veteran bringing new opportunities along your trading journey.

Practice identifying Marubozu patterns on real charts, observe their outcomes, and adjust your strategies as necessary.

Remain informed, disciplined and patient as you integrate any new pattern into your trading system remembering that successful trading is a long journey and Marubozu candlestick patterns may just help make the journey smoother.

Integrating Marubozu into your trading strategy today to take informed steps toward financial independence and success.

Frequently Asked Questions :

What Is a Marubozu Candlestick Pattern?

Answer :

A Marubozu candlestick pattern is an indicator used in technical analysis that features a full bodied candle without shadows, signaling strong buying or selling pressure throughout its trading period and showing either bullish or bearish trends depending on its hue.

How can I recognize the Marubozu Candlestick Pattern on a chart?

Answer :

To identify a Marubozu pattern on a chart, look for candles with large bodies that open at one extreme and close at the other with no wicks or tails present; this indicates a bullish Marubozu opening price was also either its low point (the lowest low point), or high point for bearish ones, while their closing prices respectively represented these positions on either end of the scale.

Does the Marubozu Candlestick pattern require confirmation?

Answer :

Unlike many candlestick patterns, the Marubozu is considered an accurate predictor due to the absence of shadows indicating sustained buying or selling pressure.

However, traders may still consult subsequent candles or volume analysis as additional confirmation for trend continuation or reversal.

Can Marubozu Candlestick Patterns be utilized for both day trading and swing trading?

Answer :

Yes, the Marubozu candlestick pattern can be utilized across many trading styles including day trading and swing trading. Due to its ability to signal strong market moves it serves as an invaluable indicator for pinpointing entry/exit points across time frames.

What should I be wary of when trading Marubozu patterns?

Answer :

Although Marubozu patterns provide an effective indicator of market sentiment, traders should use caution when trading them by considering overall market context, validating with high trading volume and integrating it with other technical analysis tools.

Furthermore, it’s crucial to have a solid risk management plan in place in order to minimize potential losses.