Intel Stock 2nd Quarter Outlook and Strategic Developments :

Intel Remarks on Comeback Challenges with Disappointing Forecast. Intel, one of the premier makers of personal computer processors, suffered significant Intel stock declines last trading session following its dismal forecast for the coming period suggesting it’s striving to return to prominence within the chips industry.

Intel Share Price Declines Amid Modest Recovery Projections:

Intel Stock, known for its high-performance personal computer processors, experienced a severe decline in its intel stock value during the last trading session.

This sharp drop came following Intel’s disappointing forecast for the upcoming quarter signalling major challenges ahead in its quest for comeback.

Intel stock projection is likely indicative of substantial hurdles it is encountering when seeking to return its former status within the competitive chips industry and has caused widespread concern among investors and industry watchers who closely track how it handles such difficulties to revive its market standing and remain on its tread.

Introduction to Intel Stock Financial Performance :

On Thursday, the firm released a statement anticipating that sales for its second quarter will reach 13% of that figure compared to an analyst consensus estimate for $13.6 billion compatible with data from Bloomberg.

Furthermore, profit before expenses is projected at 10 cents per share rather than 24 cents as originally forecast by analysts.

Intel’s Chief Director, Pat Gelsinger, recently unveiled an ambitious strategic plan designed to revitalize its fortunes something analysts predict will take both time and financial investment.

Although historically known for producing cutting-edge chips, Intel Stock now finds itself trailing industry giants such as Nvidia Corporation and Taiwan Semiconductor Manufacturing Co in terms of revenue as well as technological innovations and capabilities representing an immense challenge for Gelsinger.

Gelsinger navigates his company through an increasingly competitive environment with rival firms that have advanced more quickly in key areas than anticipated by Gelsinger himself.

Dave Zinsner, Chief Financial Officer of Intel, admitted his company had not met expectations recently; yet remained upbeat, projecting noticeable improvements over the coming months.

A significant challenge Intel Stock faced was limited manufacturing capacity that prevented it from meeting surging customer demands for components specifically tailored for AI-powered PCs – hindering their ability to meet customer requirements adequately.

“The first half of 2018 wasn’t as strong,” he noted in an interview, but expects the second half of 2018 to bring “decent force“.

Intel Stock : Cost Reduction and Profitability Projections

Intel stock shares saw their extended trading decline by as much as 9.4 percent following the report’s release, after already declining 30 percent since January 1, making them one of the two worst performers of Philadelphia Stock Exchange Semiconductor Index.

Santa Clara, California-based company reported a profit of 18 cents per share, net of items. Furthermore, revenues reached approximately $12.7 billion. Analysts had expected earnings of 13 cents per share and revenue around $12.70 billion respectively for this quarter.

Intel Corporation recently celebrated a significant milestone by recording profits under its newly revamped business structure for the first time, marking a key step in showing the results of operations under this new framework.

CEO Pat Gelsinger noted the necessity of this structural change for Intel in maintaining efficiency and competitive edge in an ever-evolving tech industry, including setting up foundry services to manufacture components on contract from other companies, thus diversifying revenue streams and strengthening Intel’s position on global markets.

Last month, Intel provided its investors with their inaugural overview of its manufacturing facility’s fiscal health.

Unfortunately, this update was far from encouraging given that Intel’s heavy investments in new plant infrastructure have led to widening losses and it doesn’t anticipate reaching breakeven point for several years.

Underscoring Intel’s difficulty optimizing production capabilities and financial performance in today’s incredibly dynamic tech landscape.

Expansion in Manufacturing and Client Securing :

Intel Corporation Foundry, Intel’s manufacturing unit, recorded revenues totaling $18.9 billion for 2023 – down from the $27.5 billion recorded the prior year – with earnings totalling $4.4 billion during its inaugural quarter in 2024.

Foundry companies reported operating deficits totaling approximately $2.5 billion during the first quarter, surpassing both prior quarter losses as well as year ago levels.

Sales of PCs that contained chips surpassed an initial estimate of $7.4 billion.

Information center services and AI division generated $3 billion – similar to Wall Street projections – while networking chips produced almost $1.4 billion of revenue, surpassing an expected average of around $1.3 billion.

Gross margin — which measures sales remaining after subtracting costs associated with production stood at 45.1 percent in Intel’s most recent quarter, reflecting efficiency within manufacturing processes and efficiency overall.

Intel Stock had recorded profits exceeding 60 percent during previous periods.

Expectations from New Gaudi Chip Release :

Intel Corporation is confident about their second quarter financial performance following the launch of their Gaudi chip iteration 3.0 AI accelerator.

Intended to rival Nvidia’s market dominance, Intel Corporation believes their Gaudi product line will make significant strides forward against Nvidia in AI technologies.

They project that this line of products will generate approximately $500 Million annually upon their release later this year; such an ambitious projection reflects Intel’s trust that Gaudi chip can capture significant market share within AI accelerator space.

Zinsner revealed that his organization is undertaking aggressive measures to cut expenses.

Through strategic adjustments and optimizations in their manufacturing processes, they expect these efforts will eventually lead to profit, Zinsner predicts this financial turnaround could occur within “the next couple of years”, marking a key step on their journey towards sustainable growth and efficiency.

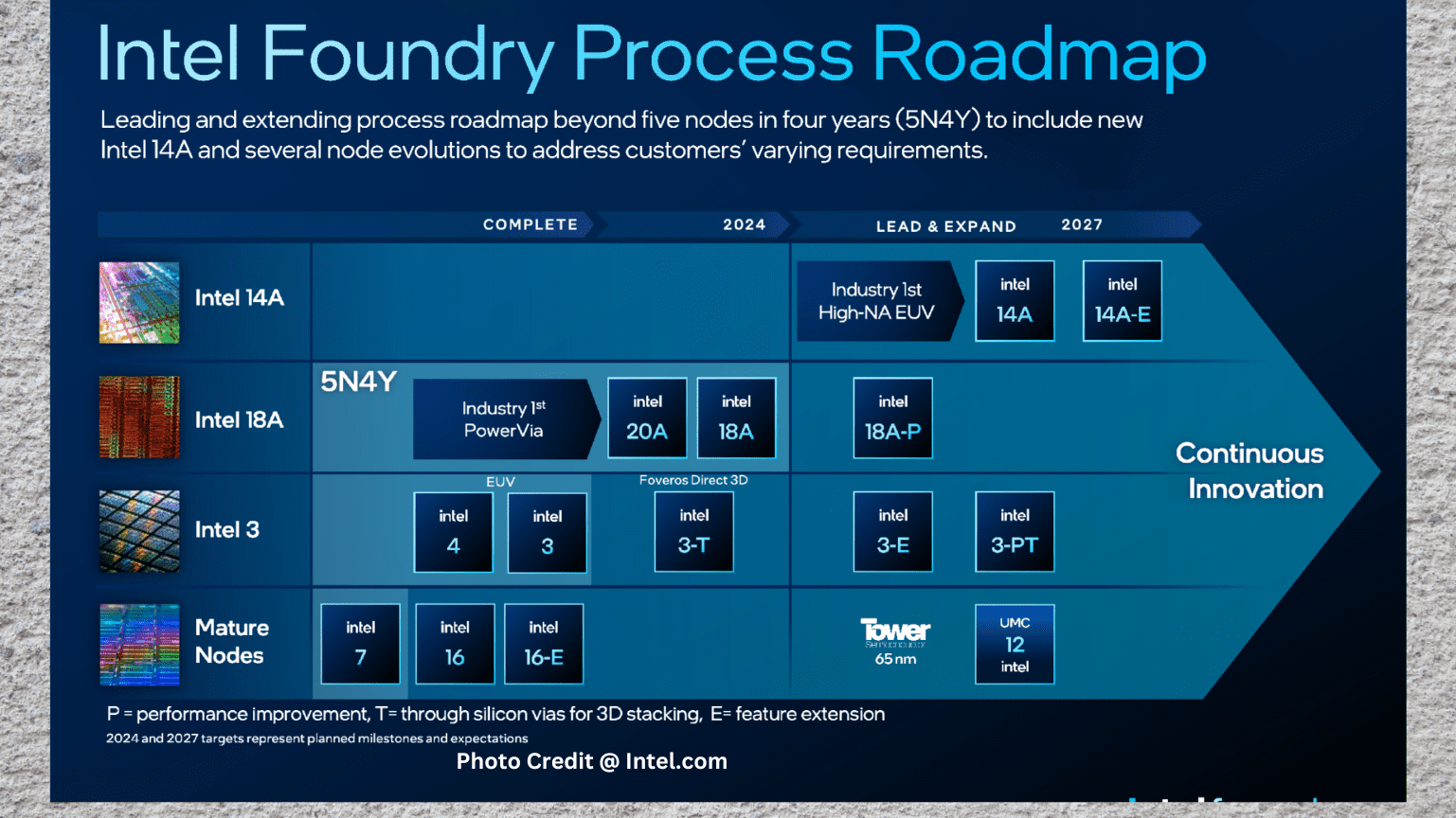

Intel Corporation Secures New Clients for 18A Technology :

Gelsinger announced that Intel Corporation has secured another client for its 18A manufacturing technology which is set to debut in 2025, bringing their total count of clients up to six.

He revealed that one client from the aerospace-defense sector specifically requests production to take place within the US something Intel has done previously with similar contracts.

Intel Corporation has identified one firm willing to use 18A : Microsoft Corporation. It plans on using Intel to design certain types of chips in-house that Software maker Intel is currently working on.

Conclusion :

- Intel’s Strategy for Growth and Competitiveness

- Efforts Towards Sustainable Growth and Profitability

Intel Corporation has shown an extraordinary commitment to diversification and innovation within its business model, adapting and expanding to an ever-evolving tech landscape.

Intel Corporation remains optimistic despite initial financial obstacles, such as manufacturing facility investments resulting in greater losses and an increasingly challenging path towards profitability.

Intel has demonstrated its dedication to reclaiming and strengthening its competitive edge through the introduction of Gaudi AI accelerator chip and signing new clients for 18A manufacturing technology, such as Microsoft Corporation.

In doing so, by streamlining operations and cutting costs they aim to overcome any current hurdles as well as achieve sustainable growth and profitability for years to come.

Web Story :

Frequently Asked Questions :

What caused Intel stock to decline recently?

Answer :

- Intel stock saw its shares decline following an underwhelming forecast for the coming period, signaling difficulties with their efforts to regain prominence within the chip industry.

How does Intel stock second quarter sales projection compare with analysts’ expectations?

Answer :

- Intel stock anticipates its second quarter sales will decrease by 13% compared to analysts’ consensus estimate of $13.6 billion, as provided by Bloomberg data.

What challenges does Intel Corporation face as part of its comeback plan under CEO Pat Gelsinger?

Answer :

- Analysts anticipate that CEO Pat Gelsinger’s plan to revitalize Intel Corporation will take longer and cost more than anticipated, due to competition from Nvidia Corp and Taiwan Semiconductor Manufacturing Co in terms of revenue generation and technological advancement.

What steps is Intel Stock taking to improve its financial performance?

Answer :

- Intel Corporation is currently working hard on cutting costs, with manufacturing expected to become profitable within several years.

- Furthermore, they recently released an improved version of their Gaudi AI accelerator chip that should compete directly against Nvidia while creating significant revenue opportunities.

Has Intel obtained any clients for its 18A manufacturing technology, set to debut in 2025?

Answer :

- Yes, Intel Corporation has secured another client for its 18A manufacturing technology which will launch later this year.

- This brings Intel’s total client count for this initiative up to six, including one from the aerospace-defense sector who specifically requests manufacturing take place within the US and Microsoft Corporation which plans on employing Intel to design certain types of chips in-house.