Learn Technical Analysis : Use Advanced Strategies in Index Options

Index options trading is an accessible way for investors looking to diversify their portfolios and take advantage of opportunities available in global markets.

The world of index options trading with our comprehensive guide. From basics to advanced strategies, learn how to master the market while avoiding common pitfalls and following in the footsteps of successful traders for long-term success

- This comprehensive guide is intended to demystify this complex trading method for beginners or experts looking for new trading avenues from understanding basic strategies up to advanced approaches employed by experienced traders, we will cover everything necessary for getting started successfully with index options trading.

Introduction to Index Options Trading :

Index options trading provides a flexible and less capital-intensive means of investing in the financial markets.

- Instead of purchasing stocks directly, which allow ownership in companies like Apple or Facebook directly through stock ownership, index options allow traders to speculate on future direction of market indices like S&P 500, Nifty or Dow Jones without directly owning those assets themselves.

Benefits and Risks of Trading in Index Options :

Benefits :

- Leverage: Index options provide leverage by giving investors control of a large amount of equity with relatively small investments.

- Flexibility: Index options provide numerous strategies which can be utilized depending on one’s market view be it bullish, bearish, or neutral. Options offer investors several potential advantages when used properly:

- Risk Management: Option contracts provide protection from potential losses within your investment portfolio,

Risks:

- Complexity : Complex strategies requiring an in-depth knowledge to trade effectively.

- Time Decay : as well as time Decay with expiration dates that mean their value could decrease over time.

- Volatility: Options prices can be extremely volatile, having an effectful on their pricing and profitability.

Understanding Index Options :

Index options are financial derivatives that give buyers the right, but not obligation, to buy or sell specific stock market indexes at predetermined prices on or before an agreed expiration date.

- They are calculated based on an underlying index; which measures different segments of the stock market using prices of individual stocks as its basis for comparison. There are two main types of index options contracts.

- Investors have the flexibility to use this leveraged approach to speculate on the overall direction of the market or hedge against potential declines, without directly trading all the individual shares that comprise it.

By exercising their option, buyers can take advantage of movement within an index without directly trading each of its component companies creating significant leverage, further amplifying both potential gains and losses.

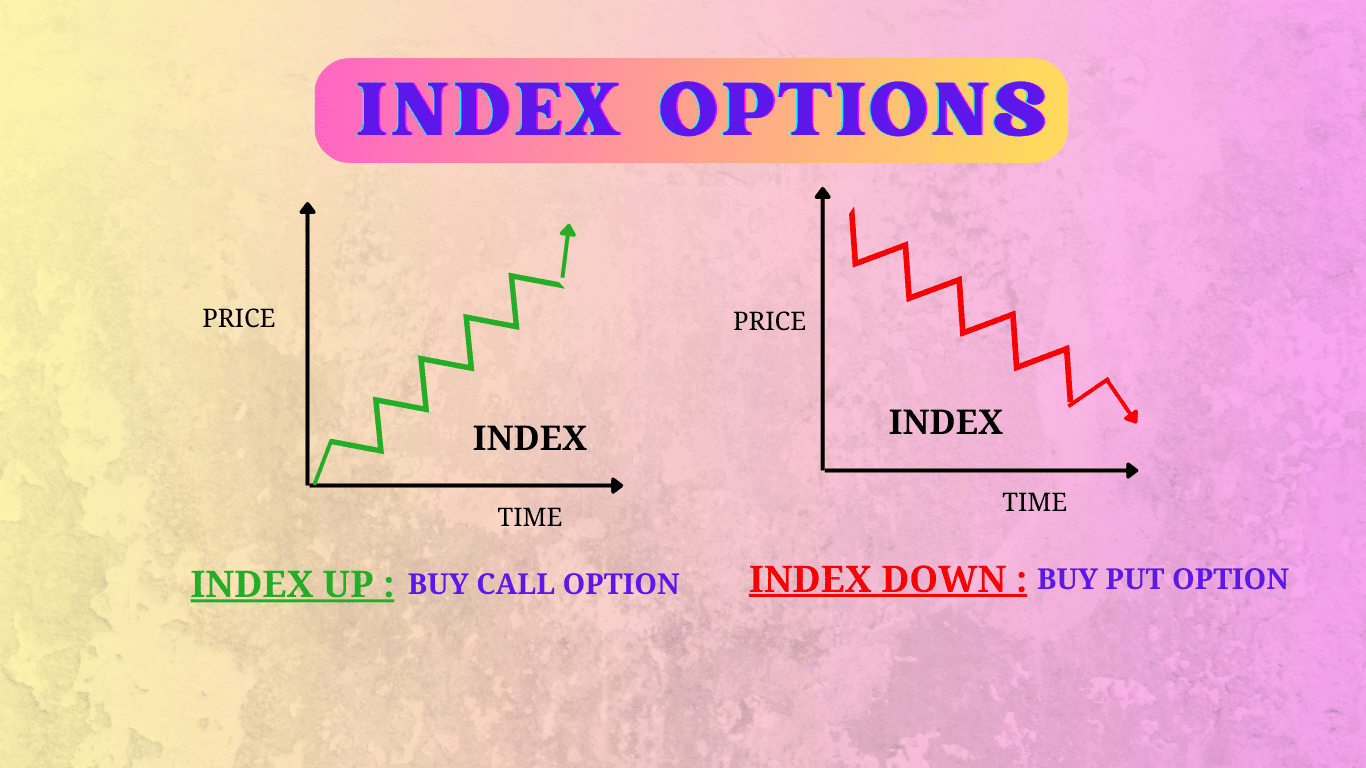

Call Options:

- These financial instruments grant their holders an exclusive right, but not obligation, to purchase an index at a predetermined price within a specified time frame and speculate on its price increase in the future.

- This enables investors to speculate on index’s future price appreciation potential.

Put Options:

- These financial instruments give the holder of these options the right to sell an index at a predetermined price, providing investors with protection from potential losses and profit potential in a declining market environment.

- They’re especially beneficial in times of market decline as investors can use this hedge against future losses or speculate for profit opportunities.

Step-by-Step Guide to Trading in Index Options :

- Selecting an Index Option : To select an appropriate index option, consider market conditions, volatility, and economic indicators when making your selection.

- Opening an Options Trading Account: Select a broker offering low fees, sophisticated trading tools and educational resources as essential criteria when opening your options trading account.

- Placing Your First Trade: Once you’ve done your research and opened an account, it’s time to place your first trade. Remember to start small and gradually increase exposure as your experience grows.

Analyzing Market for Index Options :

Proper market analysis is absolutely vital if one wishes to succeed in index options trading.

- To successfully navigate the complex market environment, traders should adopt an inclusive strategy encompassing both fundamental and technical analysis tools and techniques.

- Fundamental analysis encompasses an evaluation of factors affecting the economy and market sectors as a whole, while technical analysis examines chart patterns, volumes, and past market data to gauge sentiment, determine trend direction, and identify potential turning points.

Employing both approaches traders can gain a deeper insight into market dynamics while improving their decision making processes ultimately increasing chances of success in options trading.

Common Mistakes to Avoid in Index Options Trading :

- Over leverage: Be wary of succumbing to the temptation of controlling an excessively large sum with minimal investment capital, as this can lead to significant losses.

- Ignoring Time Decay: Keep in mind the expiration date and how time decay affects their value when considering options trading strategies.

- Skimping on Risk Management: To safeguard capital effectively and maximize.

Success Stories and Strategies from Experienced Traders :

- Currency Options: Learn from an inexperienced trader who found success with risk management and continuous learning.

- Commodity Option Trading: See how one trader combined fundamental and technical analysis techniques to identify high-probability trades and achieve consistent profitability.

- Option Writers: Explore the diverse portfolio strategies employed by a group of option writers, highlighting their market resilience.

- Momentum Option Trading: Examine a day trader who specializes in momentum option trading to find entry and exit points for entry and exit strategies.

- Option Chain Analysis: Explore how a successful trader uses option chain analysis to accurately forecast market trends.

Conclusion :

- Importance of Risk Management: Protect your capital as much as possible by prioritizing risk management strategies.

- Continued Learning and Adaption: As markets fluctuate, stay informed and adapt your strategies accordingly.

- Diversifying Portfolios: Diversifying can help reduce risks while simultaneously expanding returns potential.

Index options trading can be an immensely satisfying endeavor if you invest the time and energy into learning the ropes.

- By following the guidelines laid out herein, using proven strategies, and learning from others’ experiences, you’ll soon become a proficient index options trader. Just remember, success lies in knowledge, experience, and disciplined risk management.

Frequently Asked Questions :

What Are Index Options?

Answer :

- Index options are financial derivatives that give buyers the right, but not the obligation, to buy or sell specific stock market indexes at predetermined prices before an expiration date specified by them. They are valued based on an underlying index’s value.

What Is the Difference between Call and Put Options?

Answer :

- Call options allow investors to speculate on an index’s price increase by purchasing it at a predetermined price within a specific period.

- Put options, on the other hand, provide investors with the right to sell the index at predetermined price at any given point during time which can be beneficial in case of declining markets.

What is the significance of expiration dates in index options trading?

Answer :

- The expiration date is of paramount importance as it sets a time frame within which option holders can exercise their right to buy or sell an index, as well as impacting its value through time decay; as the expiration date approaches, its time value declines over time.

Can you describe the concept of leverage as it applies to options trading?

Answer :

- Leverage allows investors to control a significant amount of equity with relatively modest investments, amplifying potential gains while simultaneously increasing risks. Therefore, it is wise to use leverage responsibly.

What are the key elements of risk management in index options trading?

Answer :

- Effective risk management strategies include setting strict investment limits, diversifying trades, understanding the implications of leverage and time decay, as well as employing stop-loss orders to mitigate potential losses.

How can traders remain informed and adapt to market changes?

Answer :

- To remain up-to-date with market changes and remain informed, traders can keep themselves up-to-date by regularly monitoring economic indicators, market news, and technical analysis charts.

- When adapting to changes, traders must be flexible with strategies, constantly learn through resources such as courses or resources provided online courses, and adjust trade positions based on new information or market trends.