The Head and Shoulders Chart Pattern : A Complete Guide for Traders

Negotiating the complexity of stock trading calls not only knowledge of market basics but also technical analysis ability. Among the several chart patterns traders employ to forecast market moves, the Head and Shoulders chart pattern is particularly consistent and useful.

- This page delves deeply into all you require knowledge about this famous chart pattern.

- Trade the Head and Shoulders chart pattern, a consistent indicator of trend reversals in many markets.

This all-inclusive handbook addresses the pattern’s structure, detection techniques, case studies, common errors, and key trading tools. Today, share your strategies and raise your trading results.

Introduction to the Head and Shoulders Chart Pattern :

One often used chart style indicating a trend reversal is the Head and Shoulders chart pattern. It seems in many markets, including stocks, currencies, and commodities, which makes it a flexible instrument for traders.

Correct identification of this pattern might reveal obvious entrance and departure positions, so presenting major profit possibilities.

Particular Analysis of the Pattern’s Structure :

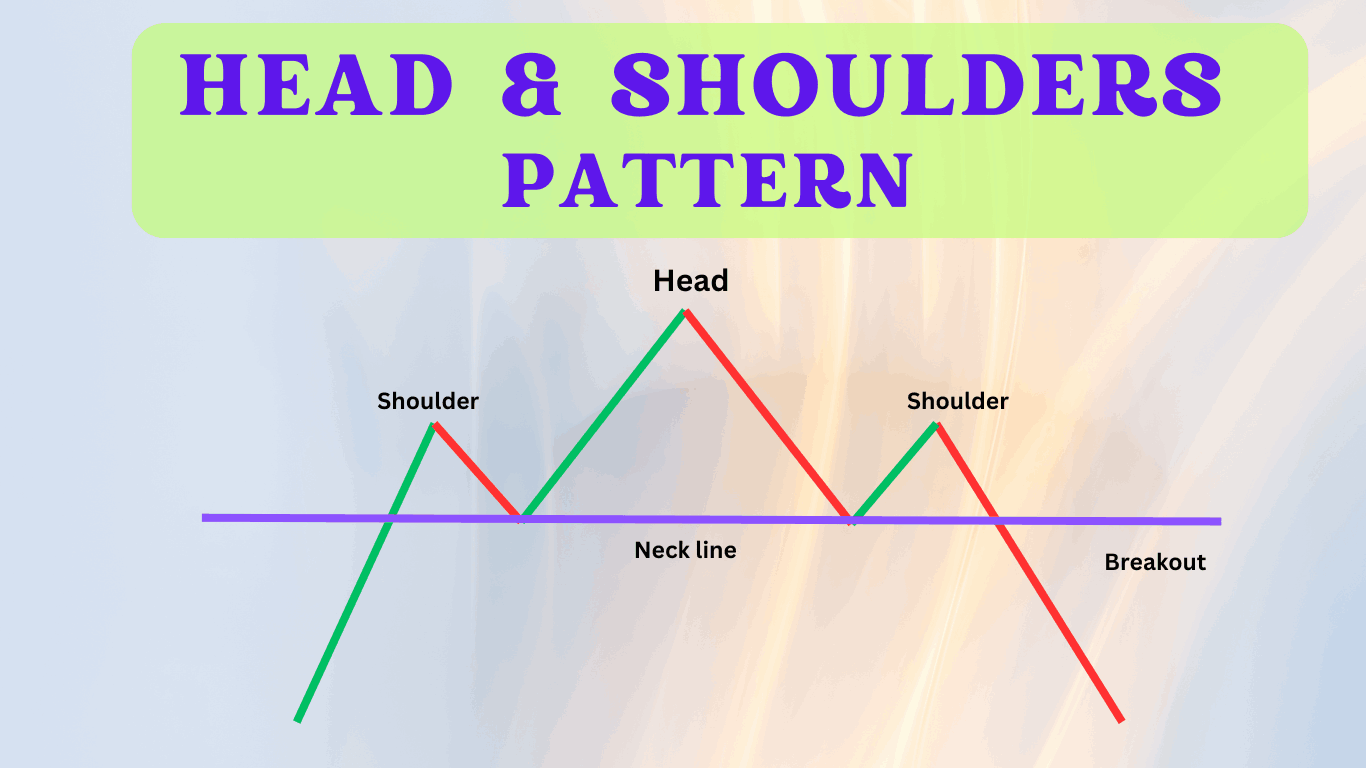

Popular in technical analysis, the Head and Shoulders chart pattern consists of three separate peaks:

Left Shoulder :

- Following a marked rising trend, this is the first apex. It gives way as price levels drop.

Head :

- The head is found at the second, highest peak. It exceeds the left shoulder in height and comes after another drop, usually suggesting a possible trend reversal.

Right Shoulder:

- Though normally behind the head, the third peak has height comparable to the left shoulder. A fall follows this peak, implying even more slowing down of the increasing momentum.

- The neckline, which is formed by linking the lows between the left shoulder, head, and right shoulder, is also absolutely vital in this design.

- Once the price moves below this neckline after developing the right shoulder, the trend is verified.

- Usually indicating a bearish reversal, this break makes traders think about selling or shorting positions.

- A lot of people trust the Head and Shoulders chart pattern to tell them when a positive trend might end and a bearish trend might start.

Finding a Head and Shoulders Chart Pattern on stock charts :

Steps toward Identification :

See the peaks :

- The three separate high points—the left shoulder, the head, and the right shoulder—are what you seek.

- With the head at the top and the two somewhat lower, nearly equal-height shoulders flanking each other, these peaks should be rather clear.

Draw the Neckline :

- Connect the lowest points between the left shoulder and the head, and between the head and the right shoulder, using a trend line.

- Considered the neckline, this line provides essential level of support or opposition.

Volume Analysis :

- Analyzing volume trends helps one to verify the pattern. Usually, the head should show declining momentum by demonstrating less volume as it forms.

- Usually accompanying the break of the neckline is an increase in volume, indicating a possible reversal and giving the pattern credence.

Significance and Conventions for Investors and Traders :

- The Head and Shoulders chart pattern is important since it indicates possible changes in market direction and usually precedes a big trend reversal.

- For traders, this pattern offers various important information and strategic points of view for behavior:

Entry Points:

- Usually entering a trade when the price breaks below the neckline, traders are confirming the pattern and a consistent indication that the trend is reversing.

• Exit Points :

- Traders create stop-loss orders above the proper shoulder to properly control risk. If the market veers off the expected declining trend, this placement helps reduce possible losses.

Profit Targets:

- Traders can project this distance downward from the breakout point by first determining the vertical distance from the head—the highest peak—to the neckline—the support level that ties the two troughs.

- This computation offers a clear goal for the transaction by helping to project a possible profit aim.

By use of the Head and Shoulders chart pattern, a trader can greatly improve his capacity to recognize and profit from key market reversals, thereby guaranteeing better informed and strategic decision-making.

- Renowned technical analyst John Murphy notes, “The Head and Shoulders chart pattern is one of the most reliable reversal patterns; when it appears, traders should take note.”

Case Studies and Sample Successful Trade Using the Pattern :

Case Study 1:

- Head and Shoulders chart pattern helped to find a successful short trade for Company X. The stock fell drastically on the neckline break, thereby giving traders who shorted it at the appropriate 15% gain.

Case Study 2:

- A trader saw a possible Head and Shoulders pattern but misread the development, therefore losing a chance. This emphasizes the need of patient and careful study.

Case Study 3:

- An inverted Head and Shoulders Chart pattern revealed a positive trend reversal that produced a 20% gain over several months.

These case studies show the possibilities of the pattern as well as warn against quick judgments.

Typical Mistakes to Avoid Using the Head and Shoulders Chart Pattern :

- Premature Entry :

often mistakes entering a trade before the neckline is broken. This can result in major losses since the pattern could not have fully evolved yet and the price might run against your position.

- Ignoring Volume :

Another important mistake is neglecting to verify the pattern using volume analysis. Volume should ideally drop throughout the head and shoulder formation and rise on the breakout to confirm the pattern.

- Overlooking Context :

Ignoring other technical indicators or the larger market background can compromise the dependability of the head and shoulders chart pattern. Making a wise conclusion requires including further research including trend direction and support/resistance levels.

Conclusion :

The Head and Shoulders pattern is a significant tool in a trader’s armory, delivering unambiguous signals for trend reversals.

- Key takeaways include:

Understanding the pattern’s structure. Patience in waiting for confirmation. Using volume and context for extra validation.

By comprehending this pattern, traders can dramatically boost their trading techniques and decision-making processes. Happy trading.

Frequently Asked Questions :

What is the Head and Shoulders chart pattern ?

Answer :

- A technical analysis chart shape, the Head and Shoulders pattern forecasts a reversal in the present trend.

- With the head highest among three peaks—the left shoulder, the head, and the right shoulder—it is composed The pattern is validated when the price falls below the neckline, therefore linking the lows between the head and the shoulders.

How reliable is the Head and Shoulders chart pattern?

Answer :

- Considered among the most consistent reversal patterns in technical analysis is the Head and Shoulders pattern. Although no pattern assures success, thorough identification and confirmation—especially with volume analysis—can greatly raise the probability of a good trade.

Can the Head and Shoulders chart pattern be used in all markets?

Answer :

- Indeed, the Head and Shoulders pattern can be used on stocks, currency, commodities, and futures among several financial markets. For traders trying to spot possible trend reversals, it’s a flexible tool.

How can I confirm a Head and Shoulders chart pattern?

Answer :

- Look for dropping volume as the head shapes and rising volume when the neckline breaks to confirm a Head and Shoulders chart pattern. This volume study supports the validity of the trend and the possibility of a reversal.

What is the difference between a Head and Shoulders and an Inverse Head and Shoulders chart pattern ?

Answer :

- A Head and Shoulders pattern indicates a negative reversal, therefore indicating the approaching conclusion of an uptrend.

- An Inverse Head and Shoulders chart pattern, on the other hand, indicates that a down trend is almost finished and forecasts a bullish reversal. Both patterns have the same identifying technique except from the general direction of the trend.