Digital Cryptocurrency Mining : GPU Usage

Introduction : learn cryptocurrency mining

- Cryptocurrency Mining was an arms race that led to increased GPU demand. Advanced Micro Devices’ stock even reached its highest trading levels ever within 10 years due to this surge.

- At this stage of cryptocurrency’s journey, however, a detailed guide on its inner workings emerged that provided insight.

- Even with increased GPU demand, however, the crypto mining gold rush quickly ended as difficulty of mining top cryptocurrencies like Bitcoin increased almost instantaneously.

- In the past few years the field of cryptocurrency mining has transformed from a pastime for hobbyists to a booming industry with sophisticated hardware and massive-scale mining operations dominated the market.

- While Bitcoin, the pioneering cryptocurrency, initially relied on individual miners using CPUs (central processing units) and GPUs (graphics processing units).

- The rise of ASIC (application-specific integrated circuit) miners has led to increased efficiency and competitiveness in the mining sector.

- Although it is a major component of the blockchain of cryptocurrency mining has also been subject to critiques due to its environmental impact as the amount of energy consumed by mining activities continues to rise.

- This has led to has been an improve in desire for alternative consensus mechanisms like proof of stake, which seeks to complete security on the network with no need to use huge computational resources.

What Is Crypto Mining?

- Many people consider cryptocurrency mining simply a means of creating new coins.

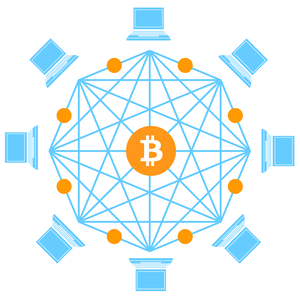

- However, crypto mining also involves validating cryptocurrency transactions on a blockchain network and adding them to a distributed ledger, moreover, crypto mining serves to prevent double spending of digital currency on distributed networks.

- As with physical currencies, when one member spends cryptocurrency the digital ledger must be updated accordingly by debiting one account and crediting the other.

- Unfortunately, due to digital currencies‘ being easily manipulable; Bitcoin’s distributed ledger only permits verified miners to update transactions and thus act as the network security mechanism against double spending.

- Meanwhile, new coins are generated to reward miners for their work in protecting the network.

- Because distributed ledgers lack a central authority, miners’ mining efforts play a vital role in validating transactions.

- Therefore they are incentivized to secure it by participating in transaction validation, increasing their chances of receiving newly issued coins as rewards for participating.

- To ensure only authorized crypto miners can mine and verify transactions, a Proof-of-Work (PoW) consensus protocol was put into effect to safeguard against external attacks on the network.

- PoW also provides protection from potential attackers.

- Cryptocurrency mining is similar to mining precious metals; while precious metal miners will unearth gold, silver, or diamond.

- Crypto miners release new coins into circulation by employing machines that solve complex mathematical equations known as hashes – digital signatures used to protect data transferred over public networks – generated during transactions of crypto coins.

- Miners compete among themselves to crack any hash value generated during cryptocurrency coin transactions that is generated and add it as the new block on their ledger with its associated reward.

- Each block utilizes a hash function to refer back to its predecessor, creating an unbroken chain of blocks all the way back to the first one.

- As such, peers on the network can quickly verify whether certain blocks are valid and whether miners correctly solved their hash to claim their reward.

- Over time, as more advanced machines are introduced by miners to solve PoW equations on the network, competition among miners increases and consequently raises cryptocurrency scarcity levels.

Cryptocurrency Mining :

- Cryptocurrency Mining requires computers equipped with special software designed to solve complex cryptographic mathematic equations.

- Early in its technology’s history, cryptocurrencies like Bitcoin could be mined with just a CPU chip on a home computer; but over time as difficulty increases CPU chips have become impractical for mining most cryptocurrencies.

- Cryptocurrency Mining requires specialized graphics processing units (GPUs) or application-specific integrated circuit (ASIC) miners.

- Furthermore, each GPU in a mining rig must always remain connected to an internet source and each crypto miner should join an online mining pool as well.

Different Methods of Cryptocurrency Mining :

- Mining cryptocurrencies takes time. CPU mining was once popular; but due to increased electricity and cooling costs and difficulty, many consider it too slow and impractical today.

- GPU mining is another method of cryptocurrency mining that utilizes multiple graphics processing units (GPUs) combined into one mining rig to maximize computational power and gain maximum computational advantage. A motherboard and cooling system is required for this setup.

- ASIC mining is another form of cryptocurrency mining.

- ASIC miners differ from GPU miners in that they’re specially tailored to mining cryptocurrencies and produce more cryptocurrency units per unit than GPU miners.

- However, these ASIC machines tend to be expensive, meaning as mining difficulty rises they quickly become obsolete.

- Given the rising costs associated with GPU and ASIC mining, The use of cloud mining is becoming more and more common.

- Through cloud mining, individual miners can use the resources of large companies or specialized crypto mining facilities without having to pay hefty upfront capital costs.

- Individual crypto miners can take the hassle-free approach to mining cryptocurrencies by selecting both free and paid cloud mining hosts online and renting a mining rig for an extended period.

- This process offers the easiest and simplest method for Cryptocurrency mining.

Mining Pools :

- Mining pools enable miners to pool together their computational resources in order to increase the chances of finding and mining blocks on blockchain networks.

- If a mining pool succeeds, its reward will be evenly divided amongst its members in proportion to their contribution of resources to it.

- Most cryptocurrency mining applications come equipped with their own mining pools; however, enthusiasts have also joined together online to form their own.

- Since certain mining pools earn higher rewards than others, miners are free to switch pools whenever it suits them best.

- Miners tend to favor official crypto mining pools more as their host companies provide frequent upgrades and technical support.

- Crypto Compare provides miners with a convenient place to compare different mining pools according to reliability, profitability and the coin they want to mine.

IS CRYPTO MINING WORTH IT?

- Determining whether crypto mining is worth it depends on a number of factors.

- From CPU, GPU, ASIC miners or cloud mining services – when selecting their mining rig based on hash rate, electric power consumption, overall costs and environmental footprint.

- Most miners tend to opt for CPU miners or GPU miners due to increased hashrate output with reduced cooling costs versus traditional miners which consume significant electricity while producing heat while mining cryptocurrency.

- An ASIC miner typically consumes 72 Terawatts of power in order to mine one bitcoin in approximately ten minutes, though these figures tend to fluctuate as technology progresses and mining difficulty increases.

- Though price matters, it is also essential to consider electricity consumption, cost of electricity in your area and cooling costs when looking at GPU/ASIC mining rigs.

- As part of their assessment of profitability, individuals should also evaluate the level of difficulty for any cryptocurrency that they intend to mine.

Tax Implications of Crypto Mining :

- Crypto mining remains an important consideration when it comes to tax.

- Crypto miners typically face tax consequences both when receiving cryptocurrency rewards for performing mining activities and when selling or exchanging the reward tokens.

- Additionally, if the mining activities of a taxpayer represent a trade or business or are conducted as an independent contractor, any reward tokens/virtual currency payments.

- Payments received as reward tokens/virtual currency payments will be considered self-employment income and subject to self-employment taxes.

Are Cryptocurrency Mining Activities Legal?

- The legality of cryptocurrency mining is unfortunately unclear in most countries as most authorities and jurisdictions have not yet passed legislation pertaining to cryptocurrencies.

Conclusions :

- For those aspiring to Cryptocurrency Mining, curiosity and an eagerness to learn are absolute requirements.

- With constantly emerging new technologies in this space, professional miners who achieve maximum results must adapt quickly by studying it closely while optimizing their mining strategies to boost performance.

- Climate change advocates have become increasingly alarmed as more fossil fuels are burned to power mining processes.

- Due to such concerns, cryptocurrency communities such as Ethereum are moving away from Proof-of-Work frameworks toward more sustainable Proof-of-Stake ones.

- cryptocurrency mining is a key factor in facilitating the decentralized and safe transfers of cryptocurrency.

- While it has created numerous opportunities and innovations however, it has also brought problems, especially in terms of environmental sustainability and energy consumption.

- As the cryptocurrency industry is evolving the need to strike the right equilibrium between efficiency, security and sustainability is essential for the longevity for mining activities.