Unveiling the Bullish Engulfing Pattern:

Market analysis in trading and investment can be likened to being a detective, seeking clues that could open the path toward future gains.

In this comprehensive guide, we will dissect the Bullish Engulfing Pattern in all its glory its subtleties revealed, its use as your guide through financial waters outlined.

One such key indicator of future profits could be found within the Bullish Engulfing Candlestick Pattern.

Technical analysts often turn to this chart pattern for understanding market sentiment and anticipating potential reversals and up trends.

Unlocking the Mystery of Bullish Engulfing Candlestick Pattern :

Technical analysis offers us lighthouses that represent change: Bullish and Bearish Engulfing Candlestick Patterns serve as beacons of change amidst market data.

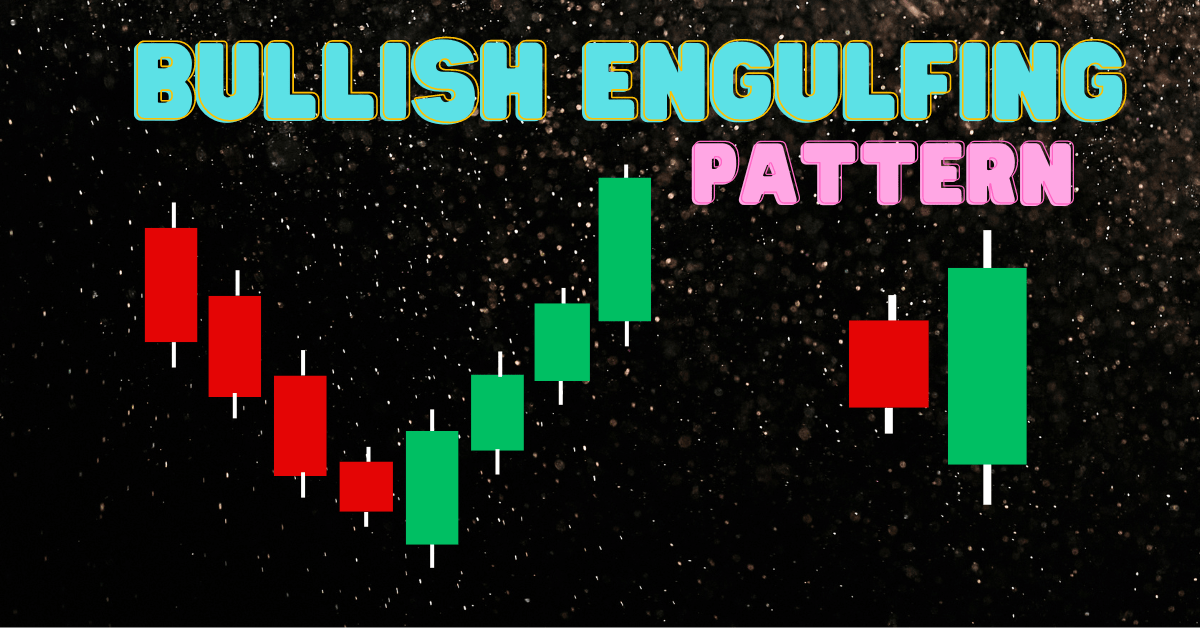

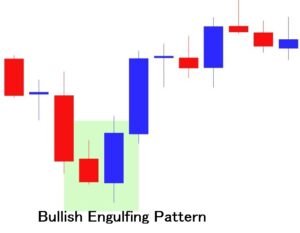

In particular, Bullish Engulfing signifies potential turnaround in an otherwise downward trending market by comprising two candles that represent different bearish market sentiment and one overpowering it with bullish energy, this pattern stands as an emblematic image of new market optimism.

Understanding the Anatomy :

A Bullish Engulfing Candlestick can be identified when its second (bullish) candle engulfs completely its first (bearish) candle and this indicates a change of control from bears to bulls with buying pressure outweighing selling pressure, often signalling a shift in market direction.

There is much history and reliability embedded into this chart pattern which helps explain its meaning.

Candlestick charting dates back to 18th-century Japan, yet, its widespread application in contemporary financial markets attests to its adaptability and timelessness.

One popular method used today by experienced traders is known as Bullish Engulfing Pattern making its presence known in their arsenal.

Timelines of Bullish Engulfing Patterns :

Traders have observed that Bullish Engulfing Patterns often appear near the end of a downtrend and just prior to its reversal. Due to its reliability over time, many traders trust this pattern as an entry point for long positions.

Charting Real-World Examples :

Markets Are Moving :

The effectiveness of the Bullish Engulfing Pattern can be seen during various historical market events. Notably during 2008’s financial crisis, this pattern signaled potential reversals in utility stocks when overall market turmoil ensued.

Furthermore, this indicator can provide buying opportunities during significant market events in forex pairs.

Navigating Uncertainty: The 2020 Corona Crisis :

Financial markets experienced unprecedented volatility during the 2020 Corona Crisis, rocking global economies to their core.

Amidst this unnerved period, traders searching for stability and potential growth opportunities turned their eyes toward technology stocks, where rapid shifts towards remote work and digital services provided fertile grounds for bullish reversals that helped signal resilience despite global disruptions.

Among others, technology stocks offered ample evidence of this pattern’s reliability by showing strong buying momentum that indicated resilience against disruptions across global economic disruptions by signaling bullish Engulfing Candlestick Pattern.

This pattern denoted buying momentum denoting resilience within certain sectors that had proven reliable buying momentum denoting resilience against global disruptions even while global disruptions occurred simultaneously across markets worldwide.

Individual Stocks as Case Studies :

Stocks often show Bullish Engulfing Patterns before experiencing significant gains after periods of consolidation or decline. Examining the technology sector reveals instances when this pattern appeared prior to upswings following product launches or earnings reports.

Mastery of Its Interpretation :

Timing and Context Are Key :

Recognizing a Bullish Engulfing Pattern is only half the battle; understanding its true significance requires factoring in volume and other technical indicators as part of an accurate interpretation process.

Mistrals and False Flags :

One must remain wary of false signals, as not every Bullish Engulfing Pattern indicates a significant market reversal.

Before making decisions based on bullish Engulfing Patterns alone, seek confirmation from multiple sources before making a definitive call.

Furthermore, knowledge of current market trends and potential catalysts is vital to avoid mistaking regular oscillations for significant pattern signals.

Integrate Bullish Engulfing Pattern into Your Strategy :

Implementing the Bullish Engulfing Pattern into Your Trading Strategy :

Integrating the Bullish Engulfing Pattern into your trading strategy goes beyond simply recognising it. Instead, it should form part of an overall framework encompassing risk management, entry/exit points and duration of trades that includes these features.

Understanding market dynamics as well as its application to various asset classes are crucial aspects.

Setting the Right Parameters :

Practice under various market conditions is crucial to setting appropriate parameters for recognizing and acting upon Bullish Engulfing Patterns.

Replicating back testing results will enable you to refine your approach by showing their efficacy in different setups and time frames.

Shield Yourself From Common Pattern Pitfalls :

Missteps and Oversight :

Even powerful tools can lead us astray if they’re used improperly, such as Bullish Engulfing Patterns. Common errors when handling them include confirmation bias, over relying on them as sole indicators, and disregarding volume rules.

To be successful when trading Bullish Engulfing Patterns it is vital that we remain adaptable in our approach based on market and individual trade conditions; adjust as necessary.

Overcoming Market Noise :

Market noise can quickly overshadow any signal of a Bullish Engulfing Pattern in today’s fast-paced trading environment, which requires staying focused, disciplined, and free of emotional turbulence when making financial decisions.

A firm grasp on risk management principles and its application within your broader strategy will give you confidence to navigate through market noise with ease.

As you start on your journey towards mastering the Bullish Engulfing Pattern, remember to keep a keen eye out for potential patterns while remaining open minded and practicing sound risk management practices.

With practice, patience, and an open mindset – with practice comes mastery.

The Conclusion that Signals the Beginning :

Patterns Have Risen :

The Bullish Engulfing Pattern is more than a chart formation; it’s a story told by the market and holds immense promise for trading and investment.

When venturing into trading or investment, use this pattern as one of your guides in your journey; pair it with sound analysis and strategic decision making to enhance your trading acumen and lead to informed, profitable decisions.

Bullish Engulfing Candlestick Pattern Can Provide Guidance :

When every tick and change in numbers carries significance, understanding and using this ancient yet timeless tool of trade provides invaluable clarity.

From novice traders trying out their first trades to veteran traders navigating volatile waters understanding this pattern can serve as your compass in an ocean of financial markets. Stay vigilant, stay informed, and may your trades be as resilient and reliable as this ancient yet timeless tool of the trade.

Frequently Asked Questions :

What Is a Bullish Engulfing Pattern?

Answer :

A Bullish Engulfing Pattern is a chart formation that often indicates a shift from down trending to uptrend.

This occurs when two red (or black) candlesticks appear close together and then one green or white candlestick completely covers its body; such an event often signals potential trend reversals from down trending to an uptrend.

How Can I Recognize a Bullish Engulfing Pattern?

Answer :

To correctly recognize a Bullish Engulfing Pattern, search for situations in which the market is clearly trending downhill.

This pattern typically appears as small bearish candles followed by larger bullish ones which fully engulf each prior candle’s body; furthermore it must open lower than its close and close higher than its open.

Does the Bullish Engulfing Pattern Guarantee Market Reversals?

Answer :

While this pattern can serve as an early warning signal of potential market reversal, it doesn’t ensure one.

Therefore, it is essential to use additional technical analysis tools and indicators alongside this pattern before making trading decisions based on this pattern alone.

Is the Bullish Engulfing Pattern applicable across various asset classes?

Answer :

Yes, the Bullish Engulfing Pattern can be utilized across several asset classes including stocks, forex, commodities and indices, its effectiveness may depend on market conditions and the asset traded thus for maximum effectiveness it is recommended that in-depth market analysis and experience be gained prior to using this strategy.

What are some common errors made when trading using the Bullish Engulfing Pattern?

Answer :

An often-made mistake for traders is over-reliance on Bullish Engulfing Pattern without considering its wider market context, ignoring volume as a confirming indicator, not waiting for additional confirmation signals and failing to implement risk management strategies.

To increase reliability, traders should combine Bullish Engulfing Pattern with other technical and fundamental analysis tools.