Follow Bitcoin Halving Event : Waiting Crypto Miners & Traders

- Let’s start with a brief introduction to Bitcoin halving event. In the world of cryptocurrency, Bitcoin halving is a significant event that occurs approximately every four years.

- It is a built-in feature of the Bitcoin protocol designed to control the issuance of new Bitcoins.

- The concept of Bitcoin halving is closely linked to the decentralized nature of Bitcoin and plays a crucial role in maintaining the digital currency’s scarcity and value.

- we explore the fascinating world of Bitcoin Halving Event.

- Whether you are an experienced investor or simply curious, this post aims to give a comprehensive understanding of this cryptocurrency market phenomenon and how its implementation could potentially alter cryptocurrency investments.

- So grab yourself a cup of tea, settle in, and let’s uncover everything there is to know about Bitcoin Halving.

- Are You Wondering about Bitcoin Halving. Everything You Need to Know If you’re an buyer with an interest in cryptocurrency, the Bitcoin halving is likely making waves in your financial world.

- From newcomers to veteran investors alike, understanding all aspects of a halving event is essential in making informed decisions about investments involving it.

- In this blog post we will take a deeper dive into everything related to a halving event such as its significance or potential effects on markets.

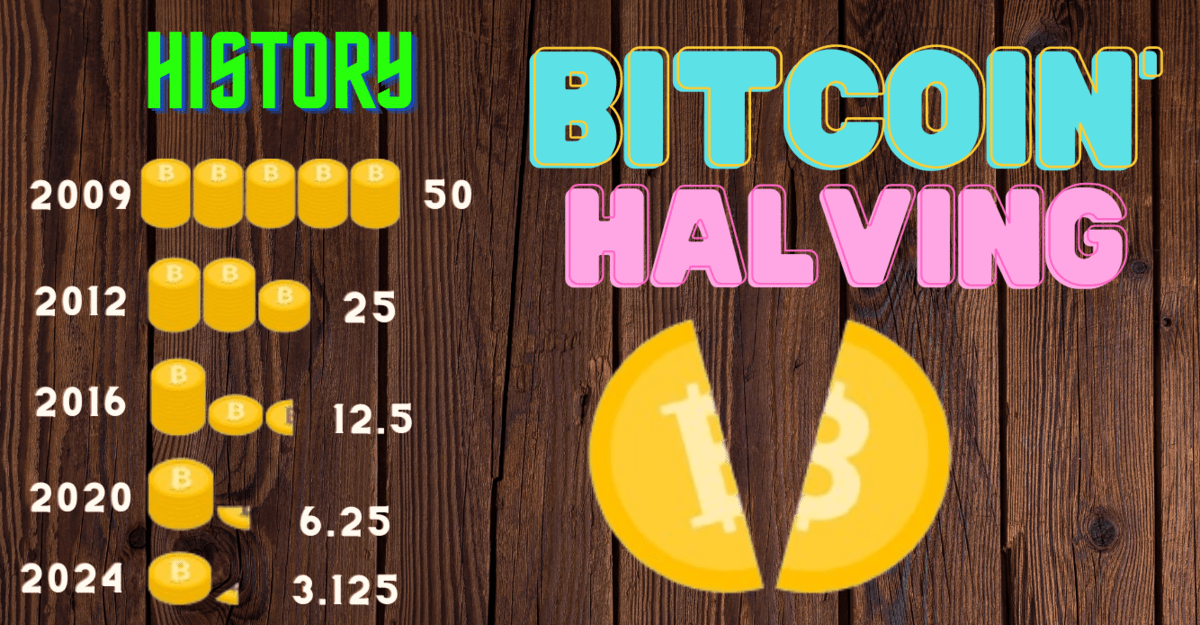

History of Bitcoin Halving :

- To understand the significance of Bitcoin halving, it’s essential to examine its historical context.

- The first Bitcoin halving took place in November 2012, approximately three years after the launch of Bitcoin.

- This event marked a pivotal moment in the evolution of Bitcoin, as it demonstrated the protocol’s adherence to a predetermined supply schedule.

- Subsequent halving events occurred in July 2016 and May 2020, and April 2024, each contributing to the gradual reduction of new Bitcoin issuance.

How Does Bitcoin Halving Events Affect Miners and Investors ?

- Bitcoin halving is an essential event in the cryptocurrency space for both miners and investors.

- This event involves cutting in half the block reward given to miners when validating transactions on the network – an event which typically happens once every four years or after approximately 210,000 blocks have been mined.

- In November 2012, Bitcoin underwent its inaugural halving when the block reward was reduced from 50 bitcoins to 25 bitcoins in an effort to control supply and increase value preservation akin to precious metals.

- Miners may experience decreased profitability as rewards for their computational efforts are reduced.

- However, historically speaking these decreases have often resulted in an increase in price as demand outpaces supply and scarcity drives demand higher.

- Bitcoin halvings can be pivotal moments for investors, having a profound effect on the market. Investors anticipate reduced new supply, prompting increased buying activity that pushes prices upward.

- But market response can vary; some halvings have led to price surges while others have had less dramatic effects.

- Overall, Bitcoin’s deflationary nature shines through during halving events, providing opportunities for speculation and investment strategies across cryptocurrencies.

- The implications of Bitcoin halving extend beyond the realm of supply and demand.

- Miners, who play a vital role in securing the Bitcoin network, experience direct repercussions from halving events.

- The reduction in block rewards directly affects the profitability of mining operations, leading to adjustments in mining strategies and hardware upgrades.

- Additionally, investors closely monitor halving events, as they anticipate potential impacts on Bitcoin’s price dynamics, often leading to heightened market volatility.

Predictions and Expectations for the Next Bitcoin Halving :

- The next Bitcoin halving is projected to take place in this year 2024, based on the predetermined schedule coded into the Bitcoin protocol.

- As the community anticipates this future event, various predictions and expectations surface regarding its potential impact on the cryptocurrency landscape.

- Speculations about price movements, mining dynamics, and market sentiment abound, driving discussions and analyses within the crypto space.

Tips for Navigating Through a Bitcoin Halving :

- Advice for Navigating Through a Bitcoin Halving, Keep an Eye on Mining Profitability.

- As a miner, it’s vitally important that after any Bitcoin halving event you keep a close watch on both block rewards and transaction fees to assess mining profitability – these two elements ultimately determine your strategy’s success or otherwise.

Be Prepared for Increased Volatility :

- For investors, Bitcoin’s halving could bring with it increased market volatility caused by speculation and uncertainty.

- Therefore, it’s wise to have a plan ready and not make hasty decisions based on short-term price movements alone.

Preparation on Market Trends :

- Just like with any investment, conducting your own research and keeping abreast of market movements prior to and post halving events is critical in order to make more strategic decisions when purchasing or selling Bitcoin.

- By keeping yourself updated with market developments leading up to and post-halving events, this can assist with making more strategic investments when buying or selling.

- For individuals navigating through a Bitcoin halving, whether as miners or investors, certain tips can help navigate the potential challenges and opportunities associated with this event.

- From diversifying investment portfolios to staying informed about market trends and technological advancements, strategic approaches can mitigate risks and capitalize on the unique dynamics surrounding Bitcoin halving.

- So, there you have it! We’ve covered the essential aspects of Bitcoin halving, from its fundamental concept to its implications for miners and investors.

- As you continue to explore the captivating world of cryptocurrencies, understanding Bitcoin halving will undoubtedly empower you to make informed decisions and navigate the evolving landscape of digital assets.

- Stay tuned for more insightful content, and remember to stay curious and open-minded as you embark on your crypto journey.

Conclusion :

- The Bitcoin halving is an integral component of cryptocurrency’s monetary policy, shaping supply and demand dynamics.

- If you are a buyer interested in Bitcoin, understanding this halving event and its effects is crucial for making informed investment decisions.

- While market fluctuations may increase during such an event, its significance highlights its scarcity as an asset class and value proposition in digital asset landscape.

- The Bitcoin Halving is an event worthy of buyers interested in cryptocurrency markets.

- By understanding its mechanics and potential impacts, investors can more confidently navigate digital assets’ constantly-evolving landscape with greater certainty and knowledge.

- In this comprehensive blog post, we’ll take you on a journey through the ins and outs of Bitcoin halving, covering everything from its fundamental concept to its impact on miners and investors.

- So hold on and get ready to become a pro at navigating the intriguing landscape of Bitcoin halving.

Frequently Asked Questions

What Is Bitcoin Halving?

Answer :

- The Bitcoin Halving Event, commonly referred to as “Halving,” is an annual event built into its protocol that sees miners’ rewards decrease by 50% for validating transactions on the blockchain, effectively cutting the rate at which new Bitcoins are created by half.

what exactly is Bitcoin halving?

Answer :

- At its core, Bitcoin halving refers to the process through which the rewards that miners receive for validating transactions on the Bitcoin network are reduced by half.

- In other words, the number of new Bitcoins generated with each mined block is halved, leading to a gradual reduction in the rate at which new Bitcoins are created.

- This process is hard-coded into the Bitcoin protocol and has a profound impact on the supply dynamics of the cryptocurrency.

Why Does Bitcoin Halving Matter?

Answer :

- The Halving Event is significant because of its effect on Bitcoin supply entering the market.

- Miners’ rewards are decreased resulting in reduced inflationary pressures leading to slower total supply increases; contributing significantly to its scarcity value proposition which often compares it to precious metals like gold.

- The significance of this event lies in its impact on the supply and demand dynamics of Bitcoin.

- By reducing the rate of new Bitcoin issuance, halving events effectively contribute to increasing scarcity, akin to digital gold.

- This scarcity factor is a fundamental driver of Bitcoin’s value proposition, as it aligns with the principles of sound money and store of value.

Potential Impact on the Market

Answer :

- Historical experience indicates that Bitcoin halving events have caused dramatic price movements within the cryptocurrency market.

- Bitcoin rallied on previous halving dates as investors anticipated decreased supply, although past performance is no guarantee of future results and reactions can vary widely across markets in response to an event such as this halving.

What Does This Mean for buyers?

Answer :

- Buyers in the considering Bitcoin or other cryptocurrencies as investments may find the halving event significant for their portfolios.

- While it’s wise to approach cryptocurrency investments with caution and conduct thorough research before investing, understanding how this event occurs may provide insights into Bitcoin’s long-term potential as a store of value.