Learn Bearish Harami Cross Candlestick Pattern: Guide for Traders

The Bearish Harami Cross candlestick pattern as a key indicator of potential bearish reversals in stock charts. Find out its components, implications for traders and how it can be integrated into trading strategies to enhance decision-making capabilities.

Introduction to Candlestick Patterns in Stock Trading :

Candlestick patterns are an invaluable asset in the arsenal of stock traders, providing valuable insight into market sentiment and potential trend reversals.

By understanding and interpreting these patterns, traders can make more informed decisions and develop successful trading strategies.

Overview of the Bearish Harami Cross Pattern :

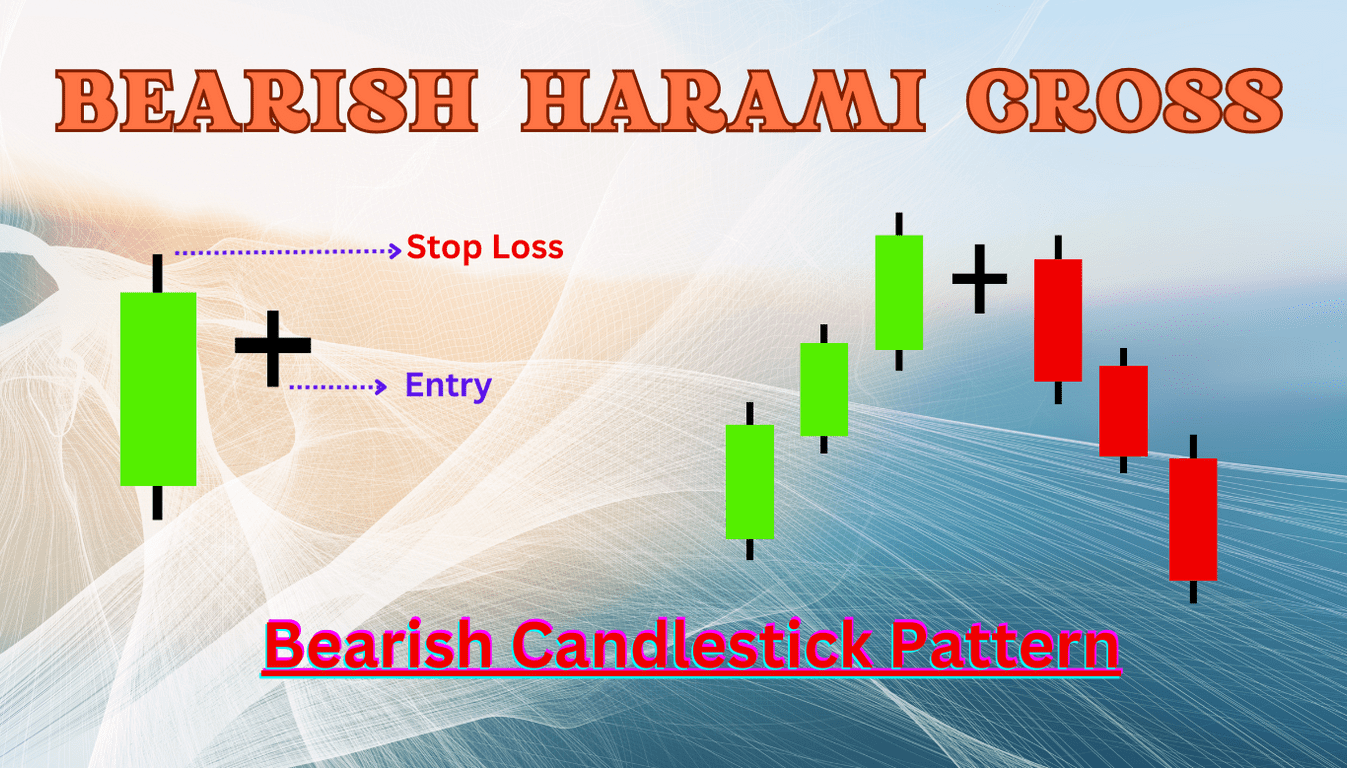

The Bearish Harami Cross is an important candlestick pattern used for technical analysis that indicates a potential bearish reversal after an uptrend has ended, easily identifiable due to its two-candle formation.

- This pattern begins with a large bullish candle, signifying strong buying pressure. Later, a smaller doji candle with minimal opening/closing difference appears and suggests uncertainty in the market.

- This doji candle has been completely swallowed up by the preceding large bullish candle’s body, indicating a shift from buyers to weakness and setting the stage for possible market direction reversal.

Description of Bearish Harami Cross Pattern :

To identify a Bearish Harami Cross, look out for two components:

- 1. A strong bullish candle during an uptrend.

- 2. A small doji candle which opens and closes within the body of an earlier bullish candle.

- 3. Doji candles should have no shadow at all to indicate market indecision.

Real-World Examples of the Bearish Harami Cross Pattern in Stock Charts :

Let’s look at real-world examples of the Bearish Harami Cross pattern seen on stock charts as it can often serve as an early warning of an impending bearish reversal following an uptrend:

Example 1:

- XYZ Stock- On the 15th of June, while experiencing a strong uptrend, XYZ stock displayed the classic Bearish Harami Cross pattern.

- This particular setup consists of a small cross candle fitting into the body of an existing large candle and signaling a change in momentum.

- Following its formation, XYZ stock reversed direction immediately, beginning a downward trend which persisted for several days – providing traders and investors a clear indication of shifting market sentiment about it.

Example 2:

- ABC Stock- In a similar manner, ABC stock experienced a Bearish Harami Cross on September 3rd shortly after experiencing brief upward movement.

- This pattern, emerging at the end of an uptrend, suggests a weakening in buyer momentum and potentially bearish market conditions leading to significant sell-off in subsequent trading sessions as anticipated by market participants who understood this signal as evidence that bullish sentiment that had propelled ABC Stock upward might now be weakening, perhaps portending more bearish outcomes in future trades.

These examples highlight the significance of understanding candlestick patterns such as Bearish Harami Cross candlestick patterns as they provide invaluable insight into market sentiment and potential shifts in stock trends.

Interpretation and Implications for Traders and Investors :

A Bearish Harami Cross pattern on a chart indicates that buying pressure, previously driving the uptrend, has begun to diminish. A small doji candle at this time indicates an uncertain market climate where neither bulls (buyers) nor bears (sellers) take definitive control.

Such a pattern often serves as an early signal that sellers begin overpowering buyers, potentially signalling an imminent downturn.

- When traders and investors encounter a Bearish Harami Cross formation, there are various important implications they should keep in mind.

- It might present opportunities for short selling to traders with bearish views as it indicates potential price decline in the near future.

- For those holding long positions, it may be prudent to tighten stop-loss orders or consider taking profits before any potential decline erodes their gains.

- Bullish traders in particular should exercise increased caution and implement effective risk management strategies when the market shows signs of instability, prompting more defensive strategies to guard against possible losses.

- When bullish trading patterns like these arise, traders need to exercise greater care when managing risks in the near future.

Understanding and responding to Bearish Harami Cross patterns can have significant ramifications for trading strategies, reinforcing the importance of technical analysis in successfully navigating financial markets.

- Potential short selling opportunities for bearish traders.

- Tightening stop-losses or taking profits on long positions.

- Increased caution and risk management among bullish traders.

Tips on Integrating Bearish Harami Cross Pattern into Trading Strategies :

- 1. Confirm the Bearish Harami Cross pattern using technical indicators such as volume, RSI or MACD to validate its bearish signal.

- 2. Set stop-losses as appropriate to manage risk should the pattern fail to trigger a substantial reversal.

- 3. Consider market trend and sentiment before making trading decisions based on this pattern.

- 4. Combine the Bearish Harami Cross with other candlestick patterns or chart analysis techniques for a comprehensive approach.

Importance of Confirmation Signals and Risk Management :

The Bearish Harami Cross pattern has become one of the most powerful indicators in trading, signalling potential reversals within bullish trends.

- However, it’s essential to keep in mind that any one pattern, regardless of its strength, carries risks, no single indicator is infallible and thus it would be wiser to seek additional confirmation from various indicators.

- Analysis can include trend and volume analyses to substantiate the initial signal from a Bearish Harami Cross.

- Furthermore, risk management must also be implemented properly setting stop-loss orders is one way of doing this to protect capital against unnecessary losses.

Diversifying and adopting prudent investment strategies such as the Bearish Harami Cross are vital components to successfully navigate markets effectively and ensure your portfolio does not overexposed to risk.

Conclusion and Key Points :

The Bearish Harami Cross candlestick pattern offers useful insights into potential bearish reversals during an uptrend. By understanding its components, interpretation, and implications traders can make more informed decisions and develop effective trading strategies.

Traders must take care to:

- Identify this pattern correctly.

- Confirm its signal with other indicators.

- Employ risk management strategies and set appropriate stop-loss orders.

- Take into account market trend and sentiment analyses.

Frequently Asked Questions :

How accurate is the Bearish Harami Cross Pattern at predicting market reversals?

Answer :

- The Bearish Harami Cross pattern can be an effective indicator for potential bearish reversals when confirmed with additional technical analysis tools, especially when combined with additional risk management strategies and indicators.

- No pattern offers 100% success rate however so it is wise to use multiple indicators and risk management techniques simultaneously for maximum success.

Can the Bearish Harami Cross Pattern Be Utilized on All Trading Markets?

Answer :

- Yes, the Bearish Harami Cross pattern can be applied across various trading markets such as stocks, forex and commodities.

- As it’s an adaptable technical analysis tool it should be tailored specifically for each market’s individual characteristics.

What does the Doji Candle represent in the Bearish Harami Cross Pattern?

Answer :

- It indicates market indecision and an impending shift from buyers to sellers, signaling weakness of an ongoing bullish trend.

- It plays a significant role in creating this pattern and can serve as an early indication that something significant may change soon enough.

What should my stop-loss settings be when trading using the Bearish Harami Cross pattern?

Answer :

- Setting your stop-loss just above the high of the first bullish candle or pattern itself may be prudent; its exact placement depends on your risk tolerance and market environment.

Should additional confirmation of a Bearish Harami Cross pattern before taking action on it?

Answer :

- Although the Bearish Harami Cross can be taken as an indicator by itself, waiting for additional confirmation through other technical indicators or chart patterns can increase its reliability and filter out potential false signals and improve strategy’s overall effectiveness.