Demystifying the Bearish Engulfing Candlestick Pattern for Traders :

Financial markets, driven by complex networks of macroeconomic indicators and psychological influences, serve as an arena in which charts, numbers, and human sentiment are all put on stage to tell their own unique tales.

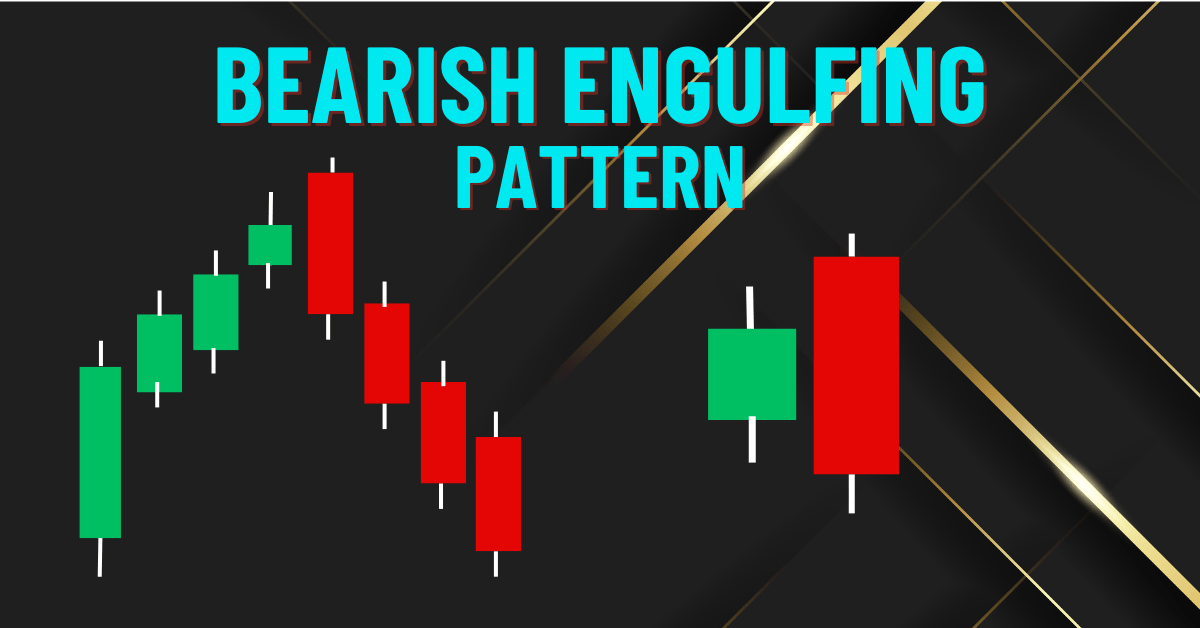

Candlestick patterns lend their voice to this narrative by signaling potential shifts in market behavior one influential motif which has caught traders’ attention is Bearish Engulfing pattern not simply an isolated blip on technical analysis radar but as a signaling potential changes indicating potential shifts that could signal potential shifts they provide early warning of potential downturns.

Introduction :

To the uninitiated, the Bearish Engulfing pattern might seem like obscure trading jargon, however, it serves an invaluable purpose of portraying market sentiment as turning bearish making it a key asset in your trading arsenal.

In this comprehensive guide on the Bearish Engulfing pattern we will unravel its depths to provide stock traders, forex investors, and technical analysts practical strategies on using it effectively.

Understanding Bearish Engulfing Candlestick :

Definition and Characteristics of the Pattern :

A Bearish Engulfing pattern occurs when a small bullish candle is completely subsumed by an subsequent large bearish candle, representing a change in sentiment from buying (bullish) to selling (bearish) and can serve as an early signal of potential trend reversal.

Candle size plays an essential role here; an increased gap can indicate more serious potential reversals in trends.

Locating the Pattern on Charts :

Price action charts make identifying price action patterns relatively simple, just look for two candles that each comprise one green (bullish) candle followed by an identical red (bearish) candle that completely covers its body, these bodies may vary in shadow size or wick size, but their bodies remain at the core.

A higher time frame increases reliability in this pattern formation process; additional criteria will assist with identification:

- First candle must have begun an up trending position

- The second candle must open significantly higher than its counterpart and close within range or below it, similar to what happened the day prior.

- Ultimately, both candles should close near or below where their counterpart opened on previous day

Deciphering the Bearish Engulfing Pattern :

Bearish Engulfing Pattern in Market Psychology :

Market psychology is at the core of market movements, making understanding it critical in deciphering candlestick patterns.

A bearish engulfing pattern signals an abrupt shift from bullish sentiment to bearish sentiment its formation signalling potential market weakness as one green candle represents buying pressure while its second red candle signifies selling pressure overshadowing these buyers, signalling potential market weakness.

Significance of the Pattern :

The Bearish Engulfing pattern holds significant weight as a reliable reversal signal, particularly when appearing at key resistance levels, trend lines or after an extended uptrend.

The larger an engulfing candle is, the stronger its signal will be of market sentiment change. Once identified as such a pattern it must then be traded accordingly

Trading Bearish Engulfing Patterns :

Entry and Exit Strategies :

This pattern offers traders a potential way to profit by entering short positions at either the close of the second candle, or at the start of the next trading day, after entering long positions at either of these times.

Protective stop loss orders should be placed above the high of an engulfing candle with profit targets set at key support levels.

It is crucial that risk management be applied; traders should avoid trading this pattern solely; instead using it alongside other technical indicators as confirmation tools.

Potential Challenges and Limitations :

Like any technical indicator, the Bearish Engulfing pattern isn’t infallible. False signals can arise during periods of high market volatility.

To effectively use this pattern for trading purposes, traders should take note of overall market trends as well as technical factors to avoid entering trades prematurely and take care in managing risk and understanding the market trends to maximize success in trading it effectively.

Historical Context and Significance :

Historically, the Bearish Engulfing Pattern has served as an accurate predictor of possible market reversals, however, like any technical pattern its effectiveness varies based on factors like timing, context, and other market influences.

Analyzing the Bearish Engulfing Pattern :

Formation and Implications :

The psychology behind this pattern is telling. A small bullish candle represents initial buying pressure, while a larger bearish candle soon after overwhelms it with overwhelming bearish momentum, often leading to further downward momentum and downtrend.

Real-Life Examples and Case Studies :

From the stock market crash leading up to 2008 financial crisis to bearish moves during Brexit vote, Bearish Engulfing patterns have played a role in numerous historic market events. Let us look closely at these examples so we can fully comprehend its influence.

Corona 2020 Financial Crisis :

The COVID-19 pandemic began early 2020, creating unprecedented disruptions across global financial markets.

Stock exchanges worldwide began plunging as economies closed their borders to stem its spread.

At this time, several asset classes displayed Bearish Engulfing patterns signaling sharp reversals in market trends major indices like S&P 500 and Dow Jones Industrial Average displayed this phenomenon to warn investors of an impending downturn further underscoring its relevance in identifying possible corrections amid global economic uncertainty.

Comparing to Other Candlestick Patterns :

Analysis with other candlestick patterns such as Hammer or Doji candlestick patterns can help illustrate the strength and reliability of Bearish Engulfing patterns like those by Japanese Candlestick Chartists can reveal more insight about their strength.

Practical Implementation in Trading Strategies :

Integrating Bearish Engulfing Into Decisions :

One simple strategy for exploiting bearish engulfing is selling short after it forms, or waiting until a breach of the low of an engulfing candle confirms a trend reversal.

Risk Management Techniques :

Given the pattern’s potential to produce false signals, effective risk management is critical. This might involve employing stop loss orders or position sizing measures as necessary, or wisely considering it alongside other indicators.

Technical Tools as Strategies :

Integrating technical tools like moving averages, Bollinger Bands or Relative Strength Index (RSI) can provide an in-depth view and confirmation of a Bearish Engulfing pattern in current markets.

The Bearish Engulfing Pattern in Current Markets :

Recent market trends and events :

We will review how Bearish Engulfing patterns have manifested themselves in this volatile and unpredictable market environment.

Predictions and Insights :

Our predictions and insights will be based on observation of historical precedents, considering how the presence of patterns could impact future market movements.

Expert Opinions mes Gaining expert opinions gives a holistic assessment of any pattern’s current relevance and future significance.

Conclusion :

Overall, Bearish Engulfing patterns remain an invaluable tool for traders worldwide.

Their ability to indicate shifts in market sentiment and potential trend reversals makes them highly sought after among investors.

Understanding this pattern enables traders to stay one step ahead in the ever evolving chess match of market dynamics.

We invite you to utilize the insights provided herein and explore all aspects of trading strategies as you continue exploring this vast universe of trading.

Implement the practices within a risk-averse, simulated investment environment before integrating them into your real trades.

We welcome hearing about how Bearish Engulfing pattern has informed your trading decisions.

Frequently Asked Questions:

What is the primary indicator of a Bearish Engulfing Pattern?

Answer :

A Bearish Engulfing pattern indicates an impending shift from bullish to bearish market trends, when an initially small bullish candlestick becomes completely swallowed up by an additional larger bearish candlestick.

How can I verify a bearish Engulfing pattern?

Answer :

To validate its signal, traders typically employ other technical indicators like moving averages or the Relative Strength Index (RSI), or by waiting for a breach of its low.

Is the Bearish Engulfing Pattern applicable in All Market Conditions?

Answer :

While the Bearish Engulfing pattern can be an invaluable asset in trading markets, its effectiveness will depend heavily on market conditions, asset being traded and any confirming signals or indicators present.

Can Bearish Engulfing Pattern Signal False Reversals?

Answer :

Yes, like all technical analysis tools, Bearish Engulfing patterns may sometimes signal false reversals, underscoring the importance of using stop-loss orders and other risk management strategies for optimal results.

How does the Bearish Engulfing pattern compare with other bearish candlestick patterns?

Answer :

As with other bearish patterns like Hammer and Doji, the Bearish Engulfing pattern stands out for its clear visual indicator of market sentiment change. However, traders often combine it with other patterns and indicators for more comprehensive analysis.