Mastering the Shooting Star Candlestick Pattern to Increase Success :

Investing in the stock market can be both art and science, depending on your approach to trading strategies.

- Technical analysts relying on candlestick patterns can use candlestick patterns as a language that signals key price moves one such candlestick pattern that holds particular appeal for traders is called the Shooting Star candlestick patterns so mastering its strategies could prove an indispensable asset in your stock market endeavors.

Introduction to the Shooting Star Candlestick Pattern: Definition

Shooting Stars are beacons that traders use as guides in the complex maze that is stock market dynamics.

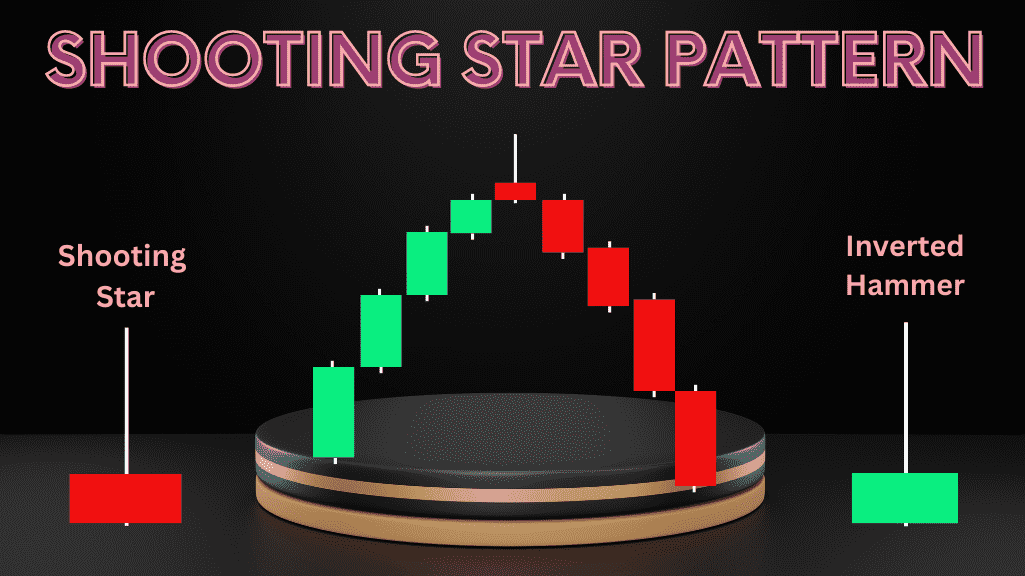

- Representing potential trend reversals, this unique shape captures highs and lows over a trading period to indicate shifts from bullishness towards potential bearishness.

- Originating in Japanese rice trading, this pattern is said to have been inspired by an ancient and luminous shooting star that illuminates the nightly skies.

- Much like this natural event draws our gaze, so too does Shooting Star draw our focus when looking at candlestick charts offering direction and meaning in fluctuating market prices.

Understanding a Shooting Star Candlestick Pattern :

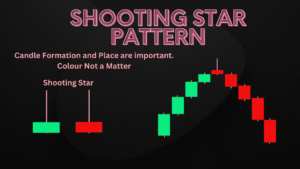

A Shooting Star candlestick pattern stands out from others in that it features distinct characteristics that distinguish it.

- This single candle formation consists of a short body at the bottom of its trading range and an upper shadow which extends at least twice further up than its body length, furthermore, no lower shadow may indicate that prices opened near high and closed near low or perhaps had an unusually small upper wick.

- Visually, the formation resembles an outer space object with a long and pointed upper wick reminiscent of comet tails or falling star, hence its name. This striking similarity to cosmic features enhances its recognizability among traders.

Significance of Shooting Star in Stock Market Analysis :

- In isolation, the Shooting Star signals a possible trend reversal when found in high volume environments without being overshadowed by other candlesticks.

- Its message of resistance against higher prices suggests an unwillingness by markets to ascend further similar to how stars that fall back down towards earth rather than continuing upward journeys into space.

- Shooting Star patterns suggest that bearish traders were successful in taking control of the price and pushing it back down during trading sessions, and this flags an impending downturn in trend, prompting long-position investors to exercise caution or offering bears an opportunity for short positions.

How to Recognize and Interpret Shooting Star Candlestick Patterns :

Identification of a Shooting Star :

- Locating a Shooting Star on a candlestick chart is relatively straightforward.

- Just look for candlesticks with long upper shadows, no lower shadow, and small bodies either white or black in color the shadow represents resistance level highs that should not be crossed, often appearing during up trends at their peaks.

Interpreting the Shooting Star :

- Understanding the context and market conditions surrounding the Shooting Star candlestick pattern is as critical to its identification.

- Is the market clearly trending up or showing volume action?

- A Shooting Star should be assessed within broader technical analysis techniques in order to verify whether a reversal may or may not occur.

- An indication for trend reversal could be further strengthened if oscillators such as Relative Strength Index (RSI) or Stochastic Oscillator signal a Shooting Star pattern in an overbought market, signaled by Relative Strength Index (RSI) or Stochastic Oscillator oscillators indicate their formation in an overbought market.

Real-World Examples Of Trading Strategies Shooting Star Candlestick Patterns :

Positioning for Profit :

- Traders frequently incorporate Shooting Stars as part of a comprehensive technical analysis strategy, often pairing it with moving averages or support and resistance levels as indicators of trend direction.

- A long term moving average may serve to signify this prevailing trend when that occurs below an SHO Shooting Star formation occurs below that moving average traders often use it to signal sell offs as soon as it occurs below its value.

Confirmation through Volume :

- Volume is an invaluable way of verifying a Shooting Star signal, as its strength depends on volume spikes on its day of occurrence.

- Increased trading volume indicates strong bearish sentiment and could indicate sustained downward momentum for an uptrend to develop over time.

Effective Risk Management :

- An integral element of trading with the Shooting Star candlestick pattern is risk management.

- Stop-loss orders should be placed just above or below the highest point of its appearance to control losses, similarly, when trading low market levels with such patterns a stop loss order should be placed just below its lowest point.

Limitations and Risks of Relying Solely on Candlestick Patterns :

- Candlestick patterns like the Shooting Star provide traders with valuable tools, but over relying solely on them could expose them to unnecessary risk.

- It is essential that traders use all available information when relying on such patterns as an investment tool, otherwise they could face unexpected risks in the market environment and technical indicators.

- Market volatility, especially in high frequency trading environments, can give rise to false or less reliable signals.

- Before making any trading decisions based on Shooting Star candlestick patterns, traders must verify the strength of these signals with other forms of analysis.

Shooting Star Candlestick Patterns in Trading Strategies :

Consistent Learning and Adaptation :

- Stay informed on current events and financial markets with active learning and observation of how markets react to current affairs is key for recognizing new trends and understanding the behavior of Shooting Star candlestick patterns in contemporary contexts.

- Always remain flexible when refining or adapting strategies according to changing market conditions.

- As with any trading strategy, it is imperative that when including Shooting Star patterns in your analysis you use appropriate risk management practices such as setting stop-loss orders and keeping in mind portfolio diversification.

Practice and Patience :

- Use demo accounts to practice recognizing and responding to Shooting Stars in real world settings.

- Simulations may result in improved pattern recognition and decision-making abilities. Patience is essential as successful traders don’t chase every shooting star, rather they wait until one that aligns with their strategies appears.

Be Adaptive :

- Markets evolve, as such, their reliability and efficiency may change quickly. Prepare to adapt your strategies according to market behavior in order to maintain success.

Combining With Other Technical Analysis Tools :

- To minimize false signals, combine the Shooting Star candlestick pattern with other technical indicators like moving averages, support and resistance levels, oscillators such as RSI or Stochastic oscillators such as moving averages. This can help confirm any possible trend reversals that might emerge.

Technical Analysis and Stock Market :

- Candlestick patterns such as the Shooting Star offer immense value not just in signalling price changes, rather they serve to train traders’ eyes to recognize patterns among all of their trading data.

- It invites us to pause, take note, and carefully consider our next move, yet reminds us that markets can change as often as the stars in the sky do.

- Continuous learning and adaptation are at the heart of any successful trading methodology.

- Technical analysts, day traders, and stock market enthusiasts who can balance the appeal of patterns like Shooting Star with an analytically sound multi pronged strategy will have an excellent chance at reaping consistent profits in the stock market.

- Shooting Stars provide traders with a tool for navigation in the celestial dance of stocks and prices, but ultimately success lies with them not their understanding or experience when navigating financial markets. Though short lived, their lessons may illuminate your trading future.

Conclusion :

- The Shooting Star candlestick pattern can serve as an indicator of potential market trend shifts. Traders should integrate it into a comprehensive technical analysis approach rather than solely rely on it.

- Understanding its significance allows traders to make better informed decisions and manage risks more effectively in stock trading markets, consequently staying updated on market conditions and adapting strategies are crucial elements of trading success.

Frequently Asked Questions :

What Is a Shooting Star in Stock Trading?

Answer :

- A Shooting Star candlestick pattern signals potential price reversals by having a short body at the bottom with long upper shadow and no lower shadow, this shows sellers began outnumbering buyers during trading sessions.

How can I recognize a true Shooting Star candlestick pattern?

Answer :

- A classic Shooting Star candlestick pattern typically forms after an uptrend and will feature a small body at the lower end of trading range with a long upper shadow at least twice its length, yet little or no lower shadow compared to its body length.

- Furthermore, confirmation should occur in subsequent trading sessions for best results.

Can I solely rely on the Shooting Star pattern when making trading decisions?

Answer :

- Although a Shooting Star candlestick pattern can signal potential market reversals, making decisions solely on this basis can be risky.

- Complementary analytics such as volume, moving averages and other technical indicators provide more comprehensive picture and reduce risk.

Where should I place my stop-loss order when trading the Shooting Star candlestick pattern?

Answer :

- An effective stop loss order could be placed just above the high point of the Shooting Star’s upper shadow to protect against losses should its projected downward trend fail to materialize and start rising again.

- In such a position, your potential losses can be minimized and losses limited if and when this trend does reverse itself and prices begin their climb back upwards.

How can I safely identify and trade Shooting Star candlestick patterns?

Answer :

- Demo accounts provided by trading platforms allow you to practice recognizing and reacting to Shooting Star candlestick patterns without risking real money.

- This practice can help enhance your pattern recognition skills as well as decision making process without worrying about real financial losses.