The Complete Guide : Inverted Head and Shoulders Chart Pattern

Overview of the inverted head and shoulders chart pattern :

Technical analysis depends on chart patterns to forecast price changes. One really strong pattern is the inverted head and shoulder one.

- For its dependability in pointing possible trend reversals from negative to bullish, this pattern is a favorite among stock traders, financial analysts, and day traders.

Trade the Inverted Head and Shoulders chart pattern using professional knowledge and real-world market case studies including stocks, forex, and cryptocurrencies.

Find important techniques, advice on risk management, and the psychology underlying this strong trend reversal indication.

Understanding the Anatomy of Inverted Head and Shoulders Chart Pattern :

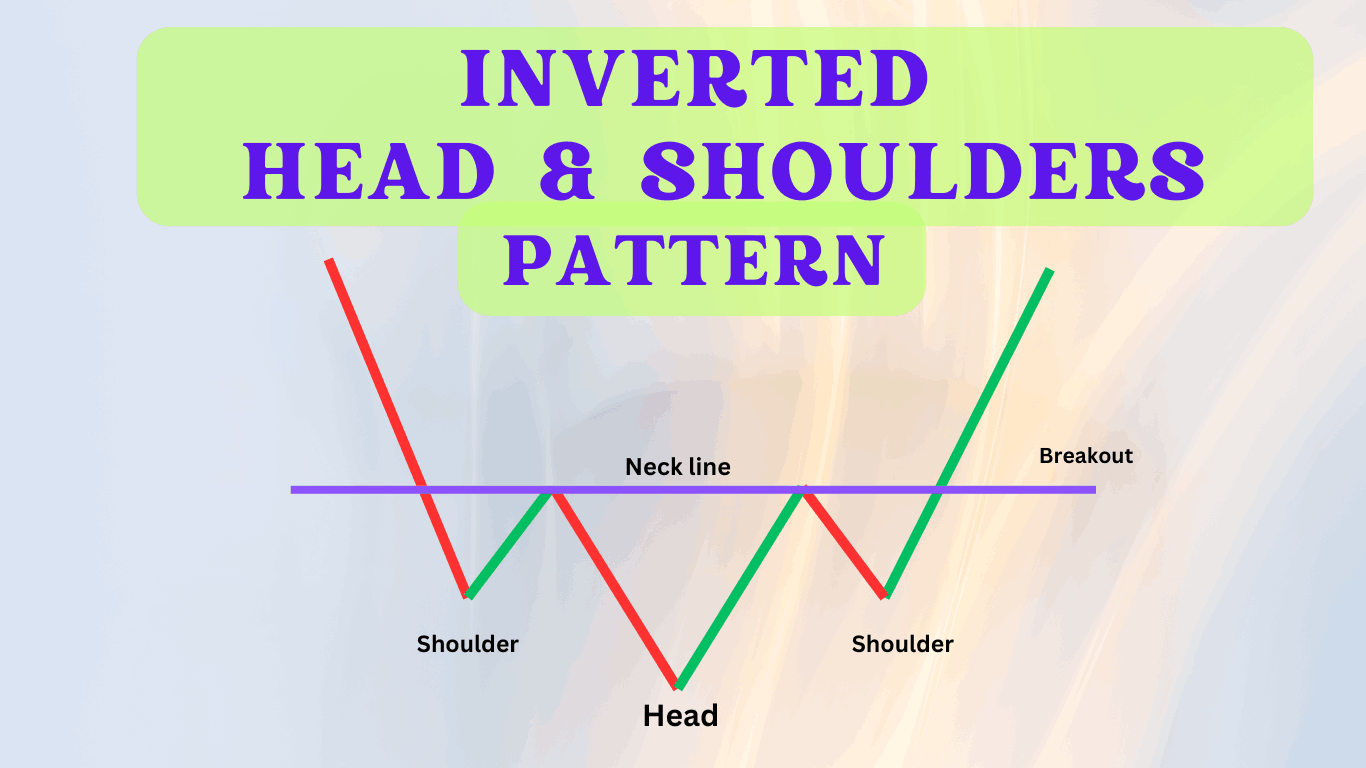

Understanding the structure of this chart pattern will help one to completely appreciate it:

Left Shoulder:

- This is typified by a decrease in the price, or first trough, followed by a rise to a peak.

- This marks the first phase whereby the market shows a notable decline followed by a comeback.

Head:

- Following a higher peak, the head forms next and is distinguished by a deeper depression below the left shoulder.

- More than any other component of the trend, this shows a significant drop in price followed by a robust comeback that exceeds the past peak.

Right Shoulder:

- At last, the right shoulder develops with a trough shallower than the left shoulder, corresponding in depth, then with a peak.

- This shows still another decline in price, although not as sharp as the head; subsequently, there is a recovery limited to the head’s peak.

- Drawing over the left and right shoulder peaks, the neckline serves as a crucial breakthrough point.

- The pattern is confirmed after the price crosses this line since it indicates a possible reversal of the trend towards optimism.

- As the price crosses above the neckline, traders generally search for further volume to validate the breakout even more.

The Psychological Underlying Inverted Head and Shoulders Chart Pattern :

- “The Inverted Head and Shoulders Chart Pattern is a powerful tool in the arsenal of any technical analyst, offering a clear visual signal of a potential trend reversal.” saya John Doe, CMT (Chartered Market Technician).

- Investors and traders alike pay close attention to this traditional chart pattern because it may indicate a major shift in the market’s sentiment or even the start of a fresh upswing.

This pattern shows three different periods of market mood, a change in attitude:

Left Shoulder :

- Initially, bears lower the price as selling pressure rises, but, when bulls intervene to raise the price, thereby creating the first trough.

Head :

- Bears try more aggressively to drive the price even lower, therefore producing a deeper dip.

- Still, once more bulls take charge, and the price moves back near the level of previous resistance.

Right Shoulder :

- In a last struggle, bears try to lower the price once more, but this time the fall is less extreme.

- Right Shoulder Bulls overwhelm the bears, producing a breakout over the neckline—the resistance level linking the head’s highest point with the left shoulder.

- For traders, this breakout over the neckline is a major confirmation since it indicates that a new rising trend is starting and the downward trend has most certainly reversed.

- Seasoned analysts maximize their investment plans and make wise trading judgments by combining this trend with other technical indicators.

- “Key is to understand the psychology underlying chart patterns such as inverted head and shoulders.

- For traders, it is a dramatic turning point as it shows a change in attitude from bearish to bullish.

Recognizing and verifying the inverted head and shoulders chart pattern :

Recognizing this trend calls for:

Seeing the Shape :

- Search for the three troughs; the head should be the lowest.

Drawing the Neckline :

- Creating the neckline, Link the shoulder peaks.

Volume Analysis :

- Verify the trend by increasing trade volume as the price moves toward breaking the neckline.

- “Key is to understand the psychology underlying chart patterns such as inverted head and shoulders.

- For traders, it is a dramatic turning point as it shows a change in attitude from bearish to bullish.

Trading Strategies for Inverted Head and Shoulders Chart Pattern :

Once found, below are some ideas to give your trading success maximum consideration:

Entry Point :

- Enter a long position when the price moves above the neckline with more volume to indicate more possible upward movement.

Stop-Loss :

- To lower risk, place a stop-loss order beneath the right shoulder.

- This lowers possible losses should the market turn against your position, therefore safeguarding your investment.

Profit Target :

- Added to the breakout point, aim for a profit target equal the distance between the head and the neckline.

- Based on past price changes, this approach helps one create reasonable and attainable goals.

- Furthermore, one should keep informed about market events and trends that could affect pricing decisions.

- Reviewing and changing your plan depending on the state of the market will improve your trading performance even more.

“When correctly identified and confirmed, the Inverted Head and Shoulders can provide excellent entry points for traders looking to capitalize on upcoming bullish trends,” says Day Trading Expert Alex Johnson.

Real-world Examples of Successful Trades Using Inverted Head and Shoulders Chart Pattern :

Example – I : The S&P 500 Index

- Examining the S&P 500 index, this trend has usually shown up before notable positive movements.

- For instance, the S&P 500 clearly showed an inverted head and shoulders pattern in [Year], which caused a significant increase movement.

Example – II : EUR/USD Forex Pair

- The EUR/USD pair displayed this pattern in the currency market, so providing a good indicator of trend reversal.

- An examination in [Year] showed how traders may profitably use this trend.

Example – III : Apple Inc.

- Apple Inc.’s stock has also displayed this trend, most famously in [Year], where it helped pinpoint buy areas for investors, hence generating notable increases.

Example – IV : Bitcoin (BTC).

- The Inverted Head and Shoulders pattern has also been helpful even in the erratic realm of cryptocurrencies.

- The chart of Bitcoin in [Year] showed this reversal and later positive trend.

Risk Management and Setting Targets with Inverted Head and Shoulders Chart Pattern :

- When trading the inverted head and shoulders pattern, risk control is absolutely vital.

- Protecting your investment and locking in gains depend on setting stop-loss orders and profit objectives, warns Michael Lee, Forex Market Analyst.

- Although the Inverted Head and Shoulders pattern is well-known for indicating a bullish reversal, without appropriate care it may also be rather dangerous.

These pointers will enable you to trade with assurance:

Use stop-loss orders :

- Always position a stop-loss below the right shoulder to reduce possible losses. This provides a safety net, therefore reducing your losses should the market turn against you.

Set Clear Profit Targets :

- Based on the height of the pattern, ascertain your profit aim. This goal should be reasonable and attainable, therefore providing you with a clear exit plan to capture benefits.

Diversify Your Portfolio :

- Avoid depending just on this trend. Add it to other technical analysis instruments and techniques to provide a comprehensive approach. This diversity lowers risk and raises the possibility of consistent returns.

- Including these risk-management techniques will help you trade much better and offer a balanced approach for negotiating the complexity of the Forex market.

Conclusion :

- All things considered, traders in all markets—from stocks to forex and even cryptocurrencies—can find a flexible tool in the inverted head and shoulder pattern.

- Correctly found and verified helps control risk and provide dependable ports of access.

Frequently Asked Questions :

What is the Inverted Head and Shoulders chart pattern?

Answer :

- A technical study chart pattern, the inverted head and shoulders pattern indicates a possible trend reversal from negative to bullish.

- There are three troughs total; the main trough—the “head”—is the lowest and is flanked by two higher troughs—the “shoulders.”

How would I verify an inverted head and shoulders chart pattern?

Answer :

- Look for a rise in trading volume as the price moves toward and breaks above the neckline—drawn by connecting the peaks discovered between the head and shoulders—to verify the pattern.

- Usually seen as confirmation is a clean breakout with more volume.

What are the best times to enter and exit this pattern when trading?

Answer :

- Usually, the best point of view comes from the price breaking above the neckline with more volume.

- Regarding exit locations, traders usually base their profit goal on the distance between the head and the neckline added to the breakout point—that is, the height of the pattern.

- Usually to reduce risk, a stop-loss order is positioned under the right shoulder.

Can I use this pattern in all financial markets?

Answer :

- Indeed, the inverted head and shoulders pattern is flexible and applicable over several financial markets, including stocks, currency, and cryptocurrencies.

- Still, it’s important to evaluate the particular market conditions and confirm the trend using volume analysis.

Is the Inverted Head and Shoulders pattern regularly dependable?

Answer :

- Though a good indication of trend reversals, no pattern is perfect.

- The Inverted Head and Shoulders pattern is to minimize possible losses, it is imperative to apply it together with other technical analysis instruments and keep a strong risk management plan.

What should I do in case the pattern doesn’t work?

Answer :

- Stop-loss orders are very important because they limit your losses if the pattern fails, which means the breakout doesn’t hold and the price goes back below the neckline.

- Reviewing the state of the market and thinking through other trends or indications will also help you hone your trading plan.