Learn Momentum Trading Strategies : Overview in 2025

Upward price movements carrying on their upward journey and downward price movements carrying on their fall, momentum trading is a successful technique that gains from current market trends.

- The successful momentum trading Strategies methods to improve your trading results.

- Through case studies and useful guidance suited to investors and traders of all skill levels, learn about breakout momentum, moving average crossover, RSI divergence, and MACD divergence techniques.

- Using “buy high, sell higher” or “sell low, buy lower,” this approach takes use of market inertia to generate income and guide wise trading choices.

- Day traders, swing traders, forex traders, currency traders, and seasoned investors alike have all swiftly come to love momentum trading strategies.

Through knowledge of and application of efficient momentum trading strategies, traders can increase their capacity to spot profitable prospects and more skillfully manage risks.

Appreciating Market Momentum :

In trading, momentum describes how fast prices move over a predetermined period of time, or the rate of acceleration in either price or volume of securities over a specific duration.

- Momentum is determined by forecasting future price changes and identifying momentum utilizing technical indicators and market signals such moving averages, relative strength index (RSI), and moving average convergence divergence (MACD).

Important Momentum Indicators :

- Moving Averages : Price data is smoothed out and patterns over various time periods are identified using moving averages.

- Relative Strength Index (RSI) : Quickly measuring the price changes, the Relative Strength Index (RSI) indicates overbought or oversold situations.

- Move Average Convergence Divergence, or MACD : Indicator that follows trends, MACD gauges the correlation between two price moving averages of a securities to provide information about its price dynamics.

Approach of Breakout Momentum :

- With this trading approach, trades are entered when prices cross a predetermined level of resistance or support and are greeted by higher volume, which suggests substantial market interest and the possibility of more price swings.

Analysis of a Case Study : The Stock Rally After the S&P 500 Declaration

- Tesla’s share price surged sharply and dramatically from $200 to over $400 in less than a month after it was added to the S&P 500 index in November 2021, demonstrating its breakthrough momentum.

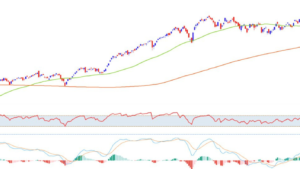

The Chart of Tesla Breakout.

Moving Average Crossover Strategy:

The foundation of its purchase signal generating procedure, this Moving Average Crossover Strategy uses two moving averages, usually 50-day and 200-day moving averages.

- When one short period moving average crosses above or below its longer period counterpart, a buy signal results, when a shorter period moving average crosses below its longer period counterpart, a selling signal results.

Case Study: Moving Average Crossover for 50 and 200 Days at Apple

- When one looks back over six months of Apple stock trading history, the 50-Day and 200-Day Moving Average Crossover in signaled a robust rising trend and, for investors who followed this signal, substantial gains.

RSI (Relative Strength Index) Strategy :

- The overbought and oversold situations are identified using the Relative Strength Index (RSI) indicator.

- The RSI of 70 or more usually indicates overbought conditions that could offer chances to sell, the RSI of less than 30 usually indicates oversold conditions that could offer chances to buy.

Report on Amazon’s RSI Signals :

- The RSI above 70 on Amazon stock indicated overbought circumstances and gave traders a chance to short-sell for a profit.

- Trades should use the Amazon RSI Chart as an indicator in this case; short sellers who acted with this signal found success short selling once it corrected.

MACD Divergence Strategy :

- The observation of divergences between the MACD line and stock price changes, the MACD Divergence Strategy finds possible reversals.

- When price hits new lows without indicating an upward reversal, there is a bullish divergence, a bearish divergence suggests an upward flip.

Analyse del MACD : Google stock displayed a bearish divergence in August 2021, when the MACD line did not rise to new highs although the price had. This suggested a potential reversal and, not long after, its price fell precipitously.

Tips for Beginner Investors and Traders to Apply These Strategies :

- Start Small : To manage the risk and gain experience, start with smaller positions.

- Stop-Loss Orders : Put stop-loss orders that cap probable losses to protect capital against them.

- Up To Date your self : Keep abreast on market news, developments, and economic signs that could change the course of events.

- Learn Patience: To prevent making snap judgments, wait for obvious indications before trading. To lower risk,

- diversify : diversify your investments among different assets.

Conclusion of Momentum Trading Strategies :

Traders of all experience levels can still benefit greatly from momentum trading strategies. Trader skill at identifying and seizing momentum will only get better with time as technology advances and real-time data availability grows.

- By learning momentum trading strategies and keeping their flexibility, traders can successfully negotiate the financial markets of today and eventually achieve long-term success.

- Ready to Trade Momentum? The success in a trading environment that is always changing requires ongoing learning and adaptability, begin investigating and implementing these techniques into your trading practice.

Best trading success and financial goal achievement, apply the best momentum trading strategies, tactics and make use of the insights in this book.

Frequently Asked Questions :

What Is Momentum Trading?

Answer :

- Using strategies called momentum trading strategies, investors focus exclusively on stocks that are moving strongly in the same direction with high volume.

- They buy upward trending stocks and sell downward trending stocks to profit from any changes in market trading momentum.

How Can I Identify Momentum of Breakout?

Answer :

- The stock price crosses a predetermined support or resistance level with more volume as moving averages, RSI, or MACD indicators confirm breakout momentum is present.

What Typical Mistakes Do New Momentum Traders Make?

Answer :

- The common errors made by new momentum traders are not properly diversifying their portfolio, making emotional trades, or setting stop-loss orders.

- Till their experience increases gradually, beginners should start in modest roles.

How Does the Moving Average Crossover Technique Operate?

Answer :

- Usually two moving averages are shorter period (eg, 50 days) and longer period(eg, 200 days), are combined in the moving average crossover strategy.

- One crosses over another and vice versa to suggest a buy signal; a cross below signals downward momentum.

Can one use momentum trading on markets other than stocks?

Answer :

- The concepts of momentum trading strategies are the same whether one trades on Forex, commodities, or even cryptocurrency; but, traders usually use market-specific indicators and tools to spot and profit from momentum in these various markets.