The Secrets of Evening Star Pattern : Trend Reversal

As an active trader or investor in today’s bustling financial marketplace, finding profitable patterns is both exciting and gratifying.

- One tool available to traders and investors alike is the Evening Star candlestick pattern, an indicator of potential imminent downtrends that analysts eagerly watch out for.

- We deconstruct the Evening Star pattern here with this definitive guide, exploring its formation, and reliability ratings and providing actionable insights that you can incorporate into your trading strategies.

Emergence of the Evening Star Pattern: A Brief History

- The Evening Star pattern originates in ancient Japanese rice trading and was later made visually identifiable using candlestick charts created by Homma Munehisa during the 18th century.

- Crafted using price and time relationships as its foundation, candlestick patterns like Evening Star evolved over centuries providing invaluable insights into market sentiment and directionality shifts.

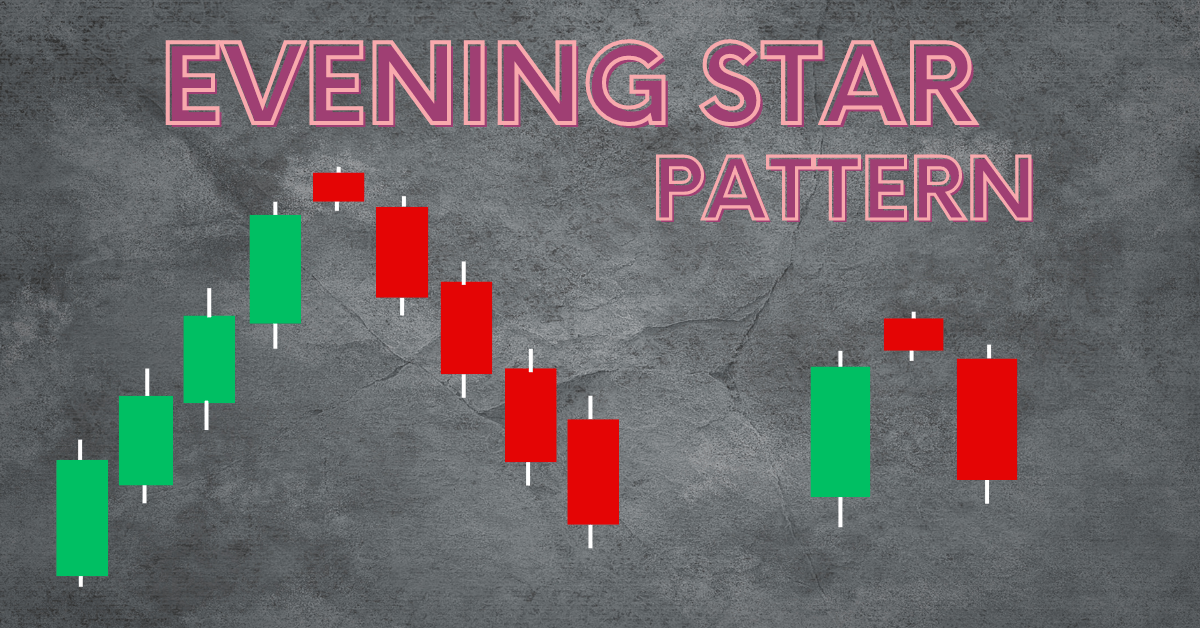

Recognize of an Evening Star Pattern :

In order to recognize stars at dusk, it is necessary to comprehend their formation. An Evening Star candlestick pattern typically appearing near the end of an uptrend and signalling potential reversal consists of three candles that represent three major candlestick formations,

- A large bullish candle, representing market optimism and upward momentum.

- A smaller-bodied candle known as the ‘Spinner’ or ‘Doji,’ symbolizing market indecision often an early signal for an inflection point which represents market indecision.

- An Evening Star candle closes deeply into its predecessor candle’s body, signaling a rejection of bullish sentiment and strong downward pull.

Visualizations of this pattern, combined with historical price patterns, can further magnify its impact and importance for trading decisions.

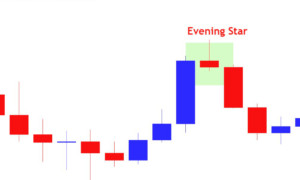

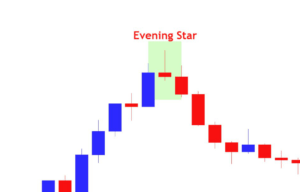

Key Steps for Spotting an Evening Star :

- Search for an Uptrend :- To recognize this pattern properly, it must occur following an extended uptrend.

- A Large White Candle :- Day One should represent a strong bullish market sentiment with an abundance of large white candles representing it on Day One.

- A short body in the middle :- Day Two progresses to reveal an indecision signaled by small bodies throughout.

- A Red Candle : – On the third day, there appears to be an expansive red candle which closes inside of its body from day one, signalling bearish reversal.

Applications in Trading :

- No trading strategy would be complete without real world applications. The Evening Star can add another layer of confirmation when used alongside other technical indicators and chart patterns, providing further direction for trading actions.

Forex and Stock Market Trading :

- The Evening Star can be applied across markets and financial instruments, from stocks, forex pairs, and commodities to investors/day traders in these sectors.

- When applied across these assets’ volatility or historical performance is key. As an effective tool for timing entry/exit points with precision.

Confirmation Through Volumes and Indicators :

- An Evening Star’s symbolic nature allows traders to read between the lines. Trading volumes provide important evidence for its strength, coupled with oscillators or trend indicators, this pattern becomes even easier to recognize as it turns from potential into probable action.

Reliability and Limitations :

- One of the key aspects of the Evening Star pattern that often sparks debate is its reliability.

- While it often heralds a price decline, some markets or stocks may defy its traditional path, when trading highly volatile markets or stocks susceptible to news driven price swings it is crucial to remain aware of potential catalysts which might overwhelm its signal provided by this pattern.

Practical Insights and Application in Strategies :

- An essential aspect of using the Evening Star pattern effectively is understanding its nuances and their effect on wider trends. Here are some insights for improving pattern recognition and timing your trades more successfully.

Essential Tips for Recognizing and Utilizing Evening Stars :

- Stay Grounded in Data :- Rely on historical records as well as keen observation to accurately detect authentic Evening Stars.

- Participate in Active Monitoring :- Actively monitoring your charts is necessary when anticipating or reacting to this pattern.

- Understand Context :- An Evening Star can have limited relevance unless placed within its wider market and sector context, which offers valuable clues as to its true narrative.

- Combine With Other Indicators : – Convergent signals or patterns can serve as powerful force multipliers when used together as part of your trading strategy.

Empirical Evidence and Case Studies :

- To provide empirical support for the Evening Star pattern, we present real life examples and case studies of successful trades that have faithfully responded to its call for reversal. To better understand its applicability and reliability across financial markets.

Continuous Learning and Application :

- Trading is an ever-evolving field with new patterns constantly emerging. Therefore, staying knowledgeable of technical analysis through candlestick patterns like the Evening Star will not only hone your proficiency but also create an edge in the marketplace.

- So remain inquisitive, keep improving your trading acumen, and try using other types of candlestick patterns too the Evening Star may just be one of many! Happy trading!

- This section could include further resources for learning technical analysis that could be integrated into trading strategies; in-depth details regarding potential risks or drawbacks associated with sole reliance upon candlestick patterns alone.

Engaging with the Trading Community :

- Engaging with a vibrant trading community can provide invaluable lessons and serve as a sounding board for new experiences and insights.

- Online forums and social media groups dedicated to technical analysis and stock market trading may prove useful when exploring the Evening Star pattern, its practical applications, or learning about technical analysis in general.

- As you journey toward mastering it, remain curious, open-minded, and resilient traits essential for success in an ever-evolving field such as trading Keep searching out those Evening Stars wisely – happy trading.

Conclusion :

- Within the volatile world of trading, the Evening Star candlestick pattern holds great potential to help guide trades towards profitability.

- But it should only be considered one tool among many available to you; to fully exploit its power it must be combined with meticulous research, understanding of market forces and good judgment.

- In conclusion, the Evening Star pattern is an invaluable asset in technical traders’ arsenal, providing invaluable insights into market sentiment and potential reversals.

- Understanding its anatomy, applications, limitations and ongoing learning can further amplify its effectiveness for trading decisions.

- As with any technical analysis tool, pairing it with other indicators or engaging with trading communities can further hone your strategy and maximize overall success.

- Stay vigilant as you observe markets to unlock all its full potential Happy trading.

Frequently Asked Questions.

What is an Evening Star Pattern in Trading?

Answer :

- A1: An Evening Star pattern in trading refers to a bearish candlestick formation that indicates a shift away from bull market trends.

- It can be identified by two consecutive long bullish candles with short body candles in between and an intervening long bearish one; both candles should have short bodies for identification purposes.

Is the Evening Star pattern reliable?

Answer :

- A2: While an Evening Star pattern can serve as a reliable signal of market reversals, its exact reliability depends on factors like its context, presence of correlating indicators and specific attributes of stocks or assets being traded.

Can the Evening Star pattern be identified across all financial markets, including stocks, forex and commodities?

Answer :

- A3: Yes. Traders should remain aware of fluctuating volatility levels and market dynamics that could reduce its predictive accuracy.

Should I use additional indicators along with my Evening Star pattern?

Answer :

- A: No other indicators are necessary when using an Evening Star pattern.

- Combining the Evening Star pattern with other technical analysis tools and indicators such as moving averages, support/resistance levels and volume analysis can significantly enhance its reliability and overall success as an investment strategy.

What can I do to enhance my abilities of identifying and trading with the Evening Star pattern?

Answer :

- A5: Mastering the Evening Star pattern requires continuous learning, practice and analysis of past trades.

- Engaging with the trading community via forums or case studies may also offer invaluable insights that enhance pattern recognition skills.